President Trump Inc.

An Analysis of President Trump’s Financial Disclosures: What we Know, Don’t Know, and Why It All Matters

By Mike Tanglis

The election of Donald Trump as president of the United States created an unprecedented situation. Never before had a businessman with a global business empire been elected president. The fact that the president of the United States would have such diverse business holdings, foreign and domestic, would pose enormous risks by itself. Trump refused to adhere to the custom of presidential nominees releasing their tax returns to the public. He opted instead to argue, falsely, that a federally mandated financial disclosure form provided far better insight into his business affairs than his tax returns would.

In this project, Public Citizen inventories the information contained within the three financial disclosure forms (known as the 278e) that Trump has filed since announcing his candidacy for president. The disclosures within these forms do much to exacerbate concerns while doing almost nothing to allay them.

Our report, President Trump Inc., describes in detail, what can and cannot be learned from the disclosures Trump made.

Trump Owns A Massive Number of Businesses

Trump’s most recent financial disclosure form shows him holding a stake in more than 500 businesses, with many of those businesses holding stakes in one another in a bewildering tangled mess. Each of these businesses would potentially stand to benefit or suffer based on the policies or express decisions made by the president of the United States. Trump’s ownership of a hotel a block from the White House and his penchant for travelling to properties he owns, such as his Mara-Lago resort, illustrates that his conflicts of interest are not merely speculative.

Trump’s Steps to Separate Himself From His Businesses Did Nothing to Allay Conflict of Interest Concerns

In the period between Election Day and Inauguration Day, President-elect Trump announced plans to separate himself from his businesses. But the steps Trump outlined merely amounted to reshuffling his businesses holdings, with himself remaining the ultimate beneficiary.

Before assuming the presidency, Trump himself held ownership stakes in hundreds of business entities. His most recent financial disclosure shows he transferred those ownership stakes to six core entities.

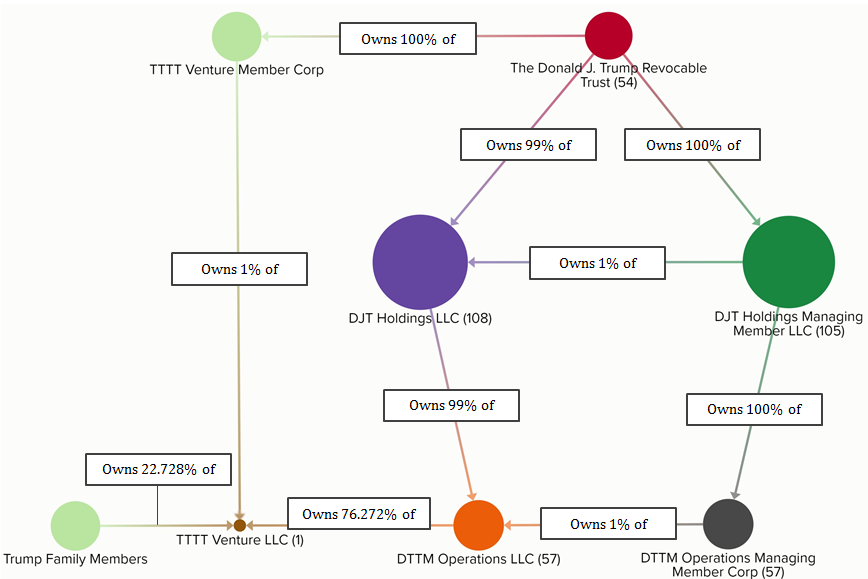

But in the end, the transfer of ownership turned out to be a meaningless shell game. Under the new arrangement, each of the entities to which Trump transferred his assets ended up under the control of a revocable trust that operates for the benefit of Trump. [See Figure Below]

Trump’s Shell Game: All Roads Lead To Trump’s Revocable Trust*

*The number next to the entity name represents the number of businesses that were previously directly owned by Donald Trump that were transferred to the listed entities as part of Trump’s post-election reorganization of his business empire. The arrow tip indicates ownership of.

The Donald J. Trump Revocable Trust is listed under Donald Trump’s Social Security number, according to the New York Times, and trust documents obtained by ProPublica clearly state: “The purpose of the Trust is to hold assets for the benefit of Donald J. Trump.” Trump can take control of, or withdraw money from, the trust whenever he wants – without disclosing it.

“It’s always good to do things nice and complicated so that nobody can figure it out.”

— Donald Trump

The Nesting Doll Structure of Trumps’ Businesses Raise Numerous Questions

Trump’s business empire was already absurdly complex before he took the additional step of transferring his assets to the six overarching entities.The typical ownership structure of a Trump business is something like a Russian nesting doll, with the revocable trust acting as the outermost layer of the nesting doll. But it is not a smooth, stackable nesting doll. Multiple “nested” entities control parts of each other, as well as parts of entities in other “nests.”

More than half of Trump’s business entities indicate a single direct owner. One might assume a business having a single direct owner translates to simplicity – but with Trump’s entities, that is not usually the case.

The vast majority of entities with a single direct owner are owned by another LLC or corporation. And these LLCs and corporations in turn may have two or more owners, which then have multiple owners, and so on. Hence, the Russian nesting doll description.

Take for example 401 North Wabash Venture LLC, a Delaware-incorporated entity that owns the Trump International Hotel & Tower in Chicago, Ill. On his 2017 form 278e, Trump reported the underlying assets of North Wabash Venture LLC as Chicago residential and commercial real estate. 401 North Wabash Venture LLC has a single owner on paper – 401 Mezz Venture LLC. But when the curtain is pulled back on that entity, 401 Mezz Venture LLC has three different owners, and so on.

Tracing the Ownership Structure of 401 North Wabash Venture LLC

Adding to the confusion, Trump often creates business entities in groups of two – a corporation and an LLC. In most cases, the corporation owns a percentage of the LLC (often only 1 percent).

For example, Trump incorporated “Trump Marks Philadelphia LLC” and “Trump Marks Philadelphia Corp.” on the same day in 2007. Trump Marks Philadelphia Corp. owns 1 percent of Trump Marks Philadelphia LLC while the Donald J. Trump Revocable Trust owns the remaining 99 percent. Trump Marks Philadelphia Corp. is 100 percent owned by the Donald J. Trump Revocable Trust. Therefore, in the end, all 100 percent of the LLC’s ownership traces back to the revocable trust. This type of ownership appears throughout Trump’s financial disclosures.

Why Trump chooses these and other complex ownership structures is not clear. Many believe these structures are designed to avoid taxes. Comments Trump made to The New Yorker’s Mark Singer in 1997, also shed light on his thinking. After a call with an investment banker, Trump told Singer:

“It’s always good to do things nice and complicated so that nobody can figure it out.”

The Financial Disclosure Forms Do Not Provide Meaningful Insight Into Trump’s Income or Liabilities

The 278e form asks respondents to answer questions in broad ranges. This inherently creates imprecision in the data. But, where Trump is concerned, the form includes even more blatant shortcomings. The form includes catch-all top-level categories of “Over $5 million” for income and “Over $50 million” for liabilities.

While these categories would rarely be invoked by most politicians, Trump often uses them. On his most recent 278e form, Trump listed liabilities of “Over $50 million” in five instances. These debts could be $50 million plus $1. But they could also be 10 times that, or, theoretically, as high as the mind could imagine. This risk to the public is manifest. In contrast to his claims of vast wealth, Trump could be drowning in debt. If so, he could be compelled to make policy decisions to avoid personal catastrophe or could be vulnerable to blackmail.

Trump’s reports of his income are also imprecise and suffer from other ambiguities. Experts and news reporters who have reviewed Trump’s reports have concluded that he likely has reported his revenue from his businesses instead of net income. In one instance, Trump reported “income” of nearly $50 million in 2014, whereas he reported to local authorities losing $2.4 million on that business in the same year. These ambiguities render Trump’s reports of his income almost useless. In contrast to his claims to having made about $600 million in 2016, Trump may actually have lost money.

More Than 70 Percent of Trump’s Reported “Income” Comes From Businesses Registered in Delaware

On his financial disclosure forms, Trump listed the majority of his businesses as operating in New York City. The financial disclosure did not require Trump to list the legal jurisdiction of these businesses, however.

Through separate searches, Public Citizen was able to determine a legal jurisdiction for about 95 percent of the businesses listed on Trump’s financial disclosure form. Of these, nearly three-fourths were registered in Delaware.

Registering businesses in Delaware is common and not illegal. Nonetheless, Trump’s penchant for setting up businesses in Delaware is interesting because the state allows businesses to operate with particularly paltry disclosure and because the state is noted as a haven for tax avoidance.

Trump Rapidly Created New Businesses After Announcing His Candidacy for President

Trump has created at least 49 business entities since he announced his bid for the Republican nomination on June 16, 2015. Roughly half of the entities were related to projects in foreign countries, including Argentina, India, Saudi Arabia, and Indonesia.

Trump had his most active day in terms of business entity formation on June 23, 2015 – just seven days after he announced his intention to seek the office of president. In total, he created 16 new entities, all in Delaware, on June 23, 2015.

The pace with which Trump created businesses after announcing for president is consistent with speculation that he intended for his candidacy to enhance his business prospects and raises questions about how he intends to use his presidency.

Conclusion

In many ways, the Trump presidency is the natural culmination of the decades-long stranglehold wealthy individuals and corporations have had on public policy. For far too long, they have achieved an outsized influence on public policy by filling the coffers of elected officials who in turn craft policy to their benefit.

But Trump has taken the standard model a step further: he has cut out the middleman – the lowly elected official – who by Trump’s own admission typically needed to be greased to make the whole process work.

As president, Trump has immense power to dictate policy and direct funds to his businesses or to others who in turn can repay him through his businesses. The knowledge that he is still ultimately in control of his businesses alone is enough to invite corruption. If a CEO travels to Washington, D.C., to lobby Trump on friendly legislation or deregulation, the real question is: why wouldn’t the CEO stay at Trump’s D.C. hotel? “Where are you staying?” may be the first question the president asks.

Trump’s financial disclosures list many of his assets around the world. As such, it provides a roadmap to wealthy individuals or corporations, foreign or domestic, friend or foe, to select their preferred vehicle to ingratiate themselves to, or gain leverage on, the president of the United States.

It’s a recipe for disaster.

Tracing Trump Inc.

Public Citizen has supplemented the data from Trump’s 278e forms and presented it in an interactive map.

The map permits users to obtain all of the information that Trump has disclosed about each of his businesses with the click of the mouse. The map will be updated as new information becomes available.

The relationship map below shows the current ownership structure of Trump’s business empire.

- The search bar on the top left allows the user to search for any of the hundreds of business entities Trump included on his 278e financial disclosures.

- The search feature also works as a keyword search. For example, if you search for “Deutsche Bank,” the entities that have liabilities related to Deutsche Bank loans will appear.

- By clicking on an individual business entity, one can view all the pertinent information included in Trump’s three 278e financial disclosures forms released from 2015 to 2017, as well as new information about the entity’s jurisdiction added by Public Citizen.

- Hovering over each entity will reveal the entity’s ownership connections, as other entities will fade.

[View in a new tab]