Federal Reserve Is Sleepwalking through Climate Chaos

European bank regulator’s latest shows just how little the Fed is doing on climate

By Yevgeny Shrago

Click Here to Sign The Petition

With Jerome Powell’s much anticipated speech at the Jackson Hole Economic Symposium having come and gone with no mention of climate change, all that anyone can talk about is whether President Biden will nominate him for another term as Chair. Powell’s defenders have pushed back on criticisms that Powell’s record on climate is lacking, with Politico claiming that he has “stepped up” on climate and the New York Times describing Powell as charting “a middle ground” between climate hawks and Republican critics.

This praise judges Powell against some easy benchmarks: Senator Pat Toomey’s climate denial and Powell’s own disdain for climate action before Biden’s election. But as climate threats to the financial system grow ever bigger and more certain, it’s important to judge Powell by how well he’s doing his whole job, which includes protecting the financial system and promoting the safety and soundness of individual banks.

Last week, the European Central Bank (ECB) released a report that highlights both the immediacy and magnitude of the climate threat to the financial system and how far behind the Fed under Powell is in addressing it. The Fed’s lack of action in response to these threats should eliminate any question about whether Powell will take the climate crisis seriously. Biden must choose a new Fed chair who will.

Sign our petition telling Biden to nominate a Fed Chair who will take action on climate-related risks.

The ECB report discussed preliminary findings from a European bank self-assessment of how well they met 13 expectations laid out in the ECB’s November 2020 climate risk guidance. The assessment found that most banks did not meet these expectations and that they were not making progress quickly enough to meet them by the end of 2022. The report provides more detail for the high level summary given in a speech by ECB Board Member Frank Elderson back in July. The report echoes one of Elderson’s key points: “the inertia a number of banks have shown so far on climate issues also serves as a clear warning to us, the supervisory authorities.” The Fed didn’t take action after that warning, so there’s little reason to think more specific details will move the needle.

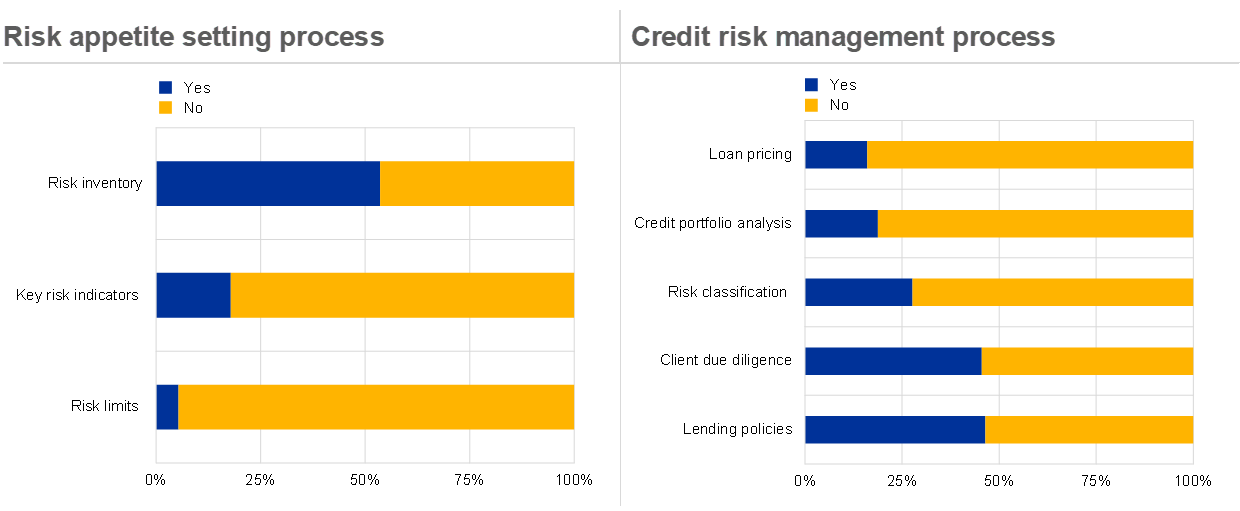

Most importantly, the ECB report warned that most banks that do assess their climate risk found that those risks will have a material impact on their risk profile. That means that shifts in fossil fuel asset prices and physical climate harms pose a threat to these banks’ business. This conclusion is especially concerning because, according to the assessment, very few banks have done more than talk about climate risk at the management level and actually incorporated it into their strategies or risk management processes. These processes are the operational nuts and bolts that determine whether a bank can actually address the threats of the climate crisis. In particular, most banks don’t incorporate climate risk into their key risk indicators or into analysis of their lending decisions. Adding to the concern, the assessment found that fewer than 40% of banks have an adequate plan for improving in these areas, and that even those that do have a plan often will not be ready by the end of 2022.

These findings raise alarms about the safety of both the EU and the U.S. financial systems. The ECB regulates eight Global Systemically Important Banks (G-SIBs), a designation for banks that could pose a systemic threat to the financial system. Failures at these banks could require yet another round of bank bailouts or even trigger a new financial crisis, like in 2008. The ECB report is telling the world that European banks themselves think they aren’t adequately prepared for the kind of major threat that could trigger such a failure—and they’re not doing enough about it.

If European banks aren’t ready for the harms of the climate crisis, there’s little reason to think the biggest U.S. banks, including eight G-SIBs, are doing any better. Indeed, U.S. megabanks are the four largest global funders of fossil fuels, a major source of climate risk. Given that the Fed hasn’t provided any guidance on climate risk to date, there’s little reason to think U.S. banks are meeting even the inadequate standard of their European counterparts.

The ECB’s reaction to this danger shows some steps that any seriously engaged regulator should take. Even before these findings, the ECB started reviewing the exposure that almost 2000 banks throughout the euro area will have to future climate risks over the next 30 years. To make sure that banks do better on climate risk, the ECB has also announced plans to issue additional guidance on best practices this fall and will conduct a full supervisory review of how banks are incorporating climate risk into their strategic and risk management frameworks in 2022. It’s possible that the ECB still isn’t doing enough and underestimating the magnitude of the danger from the climate crisis, but at least it’s taking action.

In this light, the Fed’s foot dragging isn’t a politically savvy middle ground or a “step up.” It’s utter negligence. In response to an oversight question by Senator Jon Ossoff, Powell said the Fed had made no decision yet on whether to conduct stress tests. Similarly, the Supervisory Climate Committee announced almost eight months ago has produced no reports and announced no plans to review banks’ operations or issue guidance on climate-related risk. The ECB has been publicly discussing a summary of its report findings since June. Imagine the U.S. Centers for Disease Control forming a study group in response to European reports of a novel virus, and doing nothing more. That’s the Fed on climate risk.

There’s no excuse for this inaction. The ECB and the Fed regulate banks that operate in the same globalized financial system, subject to the same global climate crisis. They have similar supervisory tools, and they have coordinated in the past on threats to the financial system. Powell has been lauded for bringing the Fed into the Network for Greening the Financial System (NGFS), a club of central banks working to address climate risk. But the point of joining the NGFS is to gain information and expertise from central banks like the ECB. Powell shouldn’t get credit if he won’t apply what he’s getting.

The ECB has raised the alarm on just how unprepared the banking system is for the climate crisis. Powell’s reaction has, at best, been the regulatory equivalent of “thoughts and prayers,” not the bold response we need to protect the financial system and the economy from the threat it faces. The time for words is over. We need a Fed Chair who will take real action.

Sign our petition telling Biden to nominate a Fed Chair who will take action on climate-related risks.