White Collar Crime Pays

A Public Citizen Survey and Blueprint for Reform

Summary

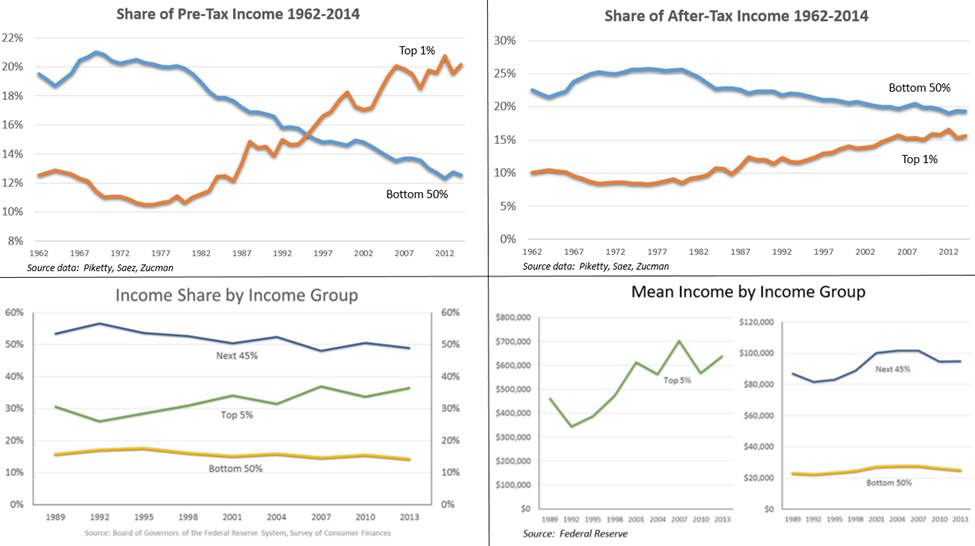

Since the 1980s, the fruits from rising economic output from workers at American corporations have concentrated earnings at the top. Average worker wages have stagnated, while those of senior managers soared. This follows a precipitous decline in the top marginal tax rate along with deterioration in the power of collective bargaining owing to declining unionization rates.

Meeting certain performance benchmarks, often pegged to a firm’s stock price, determines that senior pay. A survey of misconduct and other catastrophes of the American workplace shows the abiding presence of extraordinary pay packages.

- Because of badly constructed pay incentives, thousands of bankers engaged in widespread fraud, inflating a housing bubble whose rupture cost millions their jobs, savings and homes.

- Health care costs are rising as private equity manipulators inflate prices, opioid profiteers are addicting countless victims leading to thousands of mortalities and more.

- The worst mine disaster in recent history followed years of compensation tied to cutting safety expenses

- Similarly, corners cut at Boeing led to the crash of two airliners, while the CEO’s pay turned, in part, on cost cutting.

- Stagnating worker wages for decades to bloat the pay in the C-suite has led to massive income and wealth inequality. The induced coma of the pandemic has ripped the scar off this economic wound, requiring massive aid to newly displaced workers who have no savings to fund more than a few weeks of basic expenses, such as groceries, rent, or medicine.

Washington must to repair this dynamic. Leaders should reform executive compensation, force board directors to exercise responsible diligence over management, overhaul tax laws, and restore union organizing and bargaining rights.

Introduction

On July 21, 2010, 10 years ago, President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act. This groundbreaking legislation was a response to the worst financial crash since 1929, brought about by greedy malefactors who committed widespread fraud, largely in mortgage-making and mortgage securities trading, in the pursuit of lucre.[1] In response to this greed, Dodd-Frank directed bank regulatory agencies to adopt stricter rules in mortgage-making; tighter controls on the gambling known as derivatives trading; restrictions on banks wagering with federally insured deposits; and critically, guardrails on how bankers could profit personally. It also created a new consumer financial protection agency, the Consumer Financial Protection Bureau. In all, Dodd-Frank mandated the agencies to adopt some 400 rules. While many rules were simple, such as the mandate that companies post the CEO’s pay as a multiple of the median-paid worker at the firm to demonstrate the level of pay inequity, the agencies still labored for years to finalize them. They were besieged by bank lobbyists who considered passage of the reform measure simply the “first quarter” in football game and counted on an inevitable fading of citizen demands for reform. Perhaps one of the five most important of these 400 rules called for prohibiting incentive-based payment arrangements for senior bank officials that would encourage taking “inappropriate risks,” such as by offering “excessive compensation.” Lawmakers recognized that this reform was crucial, and because of that (unlike the vast majority of the 400 rules), they set a deadline for regulators to implement it: May 2011. Yet today, evincing the vast power of the bank lobby in Washington, this rule remains unimplemented.

Along with Dodd-Frank, Congress also approved vast sums of money to bail out the bank creditors, as the banks lacked the capital to make good on their own debts. With this debt relief, bailout proponents promised that the banks could forebear on delinquent mortgage holders and keep people who’d lost their jobs in their homes. But as the bailout proceeded, it became clear that many banks simply sat on the money and proceeded with evictions and foreclosures. In the end, more than 10 million people lost their homes, their jobs, and their savings, while bankers effectively pocketed some of the bailout, returning to the salad days of high bonuses. In the year that JP Morgan paid record fines for mortgage fraud during the years leading to the crisis, its board gave CEO Jaime Dimon a raise.[2] Had regulators completed the job of banker pay reform, and the ability to make a personal fortune even at the expense of others’ misfortune been eliminated, this could not have happened.

Now, as the world struggles with a pandemic, governments across the planet have placed their economies in voluntary comas. Millions of Americans have lost their jobs. While many low-paid workers have been deemed essential, such as those in health care, grocery sales, delivery, trash-pick up, and remain on the job, some 40 percent of Americans who were paid less than $40,000 before the shut-down are unemployed.[3] Janitors in now dark office buildings cannot telework, nor can restaurant or hotel workers. To soften the blow, Congress approved massive aid packages, which include direct payments to citizens. It also includes a massive aid package to corporations of $500 billion. With loans from the Federal Reserve, this corporate aid package approaches $5 trillion, with a goal of helping corporations retain their workforce, even as they lack the business that requires this labor.

However, the lessons of the 2008 bank bailout have left us with legitimate fears that corporate profiteers may siphon some of this aid into their own pockets, leaving less for workers.

No corporation caused the pandemic. Yet in many ways, the necessity of the CARES Act, the $2.3 trillion relief package during the pandemic, an unprecedently large measure conceived and approved in 11 days with inevitable shortcomings, and the direct $1,200 individual payments[4] stem from corruptions in high pay. Yet in many ways, the need for the government to offer trillions of dollars in relief to businesses and regular Americans was, indirectly, related to the problems excessive pay has created. Corporations spent well more than the $2.3 trillion in the CARES Act on buy backs of their own stock in recent years. Those buybacks sparked increases in the stock price to which senior pay is pegged. Corporations failed to reward workers for productivity gains with real wage growth for decades, instead bloating the paychecks of senior executives. Hence, almost half of Americans lack even $400 in savings to buy groceries beyond a few weeks during the lockdown.[5]

So, with the failures of leaving reforms incomplete from the 2010 Dodd-Frank law standing as a stark object less in the bank bailout, Congress must not repeat that error, and must be diligent to ensure that the trillions in aid goes not to corporate profiteers but to workers. That means strong complete transparency of where the money goes and on what terms, oversight to ensure that recipients are worthy, and vigilant police and prosecutors to hold wrongdoers accountable.

I. Corruptions from High Pay

From World War II through the 1970s, the rewards from America’s collective economic effort was spread somewhat evenly across the workers of U.S. corporations.[6] When productivity increased, that is, when the value of what was produced each hour increased by a certain amount year-to-year, wages increased across firms by roughly that same amount.

During these decades, organized labor played an important role in determining the pay both for workers represented by the unions, and others whose employers, though not unionized, still needed to compete with these wages. The Taft-Hartley Act of 1947 limited labor organizing, which had been rising, so that the percentage of Americans represented by unions peaked in 1954 at 35 percent.[7] Still, the number of union members grew for the next several decades, even if by less than employment growth, so that the total number of union members peaked in 1979 at 21 million. Collective union bargaining power helped police the equitable allocation of income from economic growth during these post-war decades.[8]

Meanwhile, tax policy discouraged extraordinary paychecks. In 1963, the top marginal tax rate for individuals was 91 percent, down from 92 percent in 1952.[9] This top rate of 91 percent applied to any income beyond $400,000.[10] That meant that compensation above this amount really meant revenue for the IRS. For example, in 1950, the highest paid CEO in the United States was Charles Wilson of General Motors. He received $626,000.[11] [12] In 1974, more than 20 years later, with high marginal tax rates, the GM CEO received $923,000, an increase that largely kept pace with inflation over this period. Moreover, that 1974 GM pay package generated shareholder criticism as overpayment and led to a donation of shareholder money to Uncle Sam.[13] When compared with average workers, CEO pay held steady from the end of the war through the 1960s. In 1965, the average CEO of the largest 350 firms received 20 times the pay of the average worker. That was in line with the advice of management guru Peter Drucker now offers.[14]

By the early 1980s, however, union power began to decline precipitously. Observers point to a strike by air traffic controllers, in which President Ronald Reagan responded by permanently terminating the workers. Historians consider it “one of the most important events” in late 20th century U.S. labor history.[15] The momentous move by a sitting president opened the door for similar and even more draconian anti-union behavior by private sector managers, including replacing striking workers with scabs—non-union replacements. A Reagan official noted at the time, “When the president said no [to the workers]… American business leaders were given a lesson in managerial leadership that they could not and did not ignore.”[16] Beginning in the 1980s, union membership declined, as the power of the strike became less effective. Even though the population of the United States has doubled since 1960, the number of workers represented by unions has declined from about 20 million to 14 million today, and [17]union density stands at 10 percent nationally. This figure masks the fact that union density among government workers stands at 33 percent, and for private sector workers, the figure is 6.2 percent.[18] At the end of 2019, there were 7 million private sector union members out of 144 million total American workers.

Since the 1980s, wages for average workers have stagnated. While productivity has continued to increase, the benefits of greater economic output has not found its way into the pockets of the line employees most responsible for that greater output. Instead, it has gone to senior employees of American corporations.

Another Reagan legacy: the 1981 Economic Recovery Act. The top marginal tax rate for individuals, which had already fallen to 70 percent before his presidency, was further reduced to 50 percent.[19] Reagan pushed tax cuts again in 1986, lowering the top marginal rate to 38.5 percent. [20]

With lower tax rates on top salaries, and less pressure from unions to raise worker wages, company managers began to concentrate company income on larger CEO and senior management salaries. In most cases, the bulk of larger compensation packages came in the form of incentive plans. If the manager met a certain target, such as increased sales, or reduced expenses, then he or she received a bonus. [21]

Nevertheless, pursuing goals to achieve extraordinary payoffs has occasionally led to extraordinary behavior by senior managers. If one surveys corporate misconduct, one factor seems ever present—money. The subsequent sections of this chapter demonstrate that there is a big problem with corporate misconduct. Whether it is bank fraud, health care profiteering, mine safety infractions, flawed commercial jet design, or book-cooking, the common motivating agent seems to be money, the ability for the bad actor to grow rich from the misconduct.

In fact, the connection between corporate misconduct and money seems axiomatic.

The following is an overview of the landscape of recent corporate misconduct and the tie to extraordinary compensation.[22]

Banking

Pay structures tied to performance played a central role in the 2008 financial crash. The Financial Crisis Inquiry Commission found that pay systems too often encouraged “big bets” and rewarded short-term gains without proper consideration of long-term consequences.[23] At Washington Mutual, investigators found that pay incentives throughout the firm played a major role in inducing the bank to make inappropriately risky loans, eventually driving the firm into bankruptcy.[24] Washington Mutual was one of the largest banks to fail in history.

Senior managers overseeing what would become disastrous strategies received astonishing paychecks. Harvard Professor Lucian Bebchuk found that the wages of failure were very good. The 10 senior executives of Bear Stearns and Lehman Brothers, which failed under those executives’ leadership, were paid $1.4 billion, including severance packages, in the years leading to the crash. That’s an average of $140 million each. They made riches to risk—and lose—their companies.

Wall Street bankers themselves acknowledge that compensation practices played a central role in promoting excessive risk-taking behind the financial crash.[25]

The 2008 financial crash centered around unsafe mortgage-making and trading. Risky mortgages became part of complicated debt packages, sold to investors around the world. When mortgage borrowers began to default, the problems spread throughout the financial plumbing. Misguided pay structures figured at every stage. Mortgage sales agents intentionally sold expensive, subprime mortgages to borrowers who qualified for better, prime mortgages. That’s because subprime mortgages generated the sales agents better commissions.[26] Securitization of those mortgages into bonds meant lucrative underwriting fees for investment bankers. When the supply of sound mortgages began to dwindle, as most qualified borrowers already owned homes, the industry reduced its underwriting standards, awarding mortgages to unqualified borrowers, to keep the fee-generating securitization machine buzzing.

Bankers also profited from failure. Goldman Sachs bankers generated fees for themselves by bundling bad mortgages into securities they sold to investors, and then won more by placing bets those securities would falter.[27]

In the restrained terms of the SEC:

Poorly structured incentive-based compensation arrangements can provide executives and employees with incentives to take inappropriate risks that are not consistent with the long-term health of the institution and, in turn, the long-term health of the U.S. economy. Larger financial institutions are interconnected with one another and other companies and markets, which can mean that any negative impact from inappropriate risk-taking can have broader consequences. The risk of these negative externalities may not be fully considered in incentive-based compensation arrangements, even arrangements that otherwise align the interests of shareholders and other stakeholders with those of executives and employees.[28]

Senior bank managers obscured vital risk information. This misled shareholders, auditors, and prudential supervisors.[29] This stemmed from the fact that senior managers were compensated largely in stock options. Firms that pay executives with stock options provide an asymmetric incentive to produce financial results that may involve excessive risks. If the risks lead to rewards, the stock options can pay handsomely. If those risks instead lead to losses, the manager does not suffer a loss of pay. Steven Harris, then a member of the Public Company Accounting Oversight Board, observed that certain stock-option plans proved to be “strong incentive for excessive risk-taking.”[30]

The Financial Crisis Inquiry Report found that “massive losses” related to the subprime mortgage market stemmed from employee compensation systems.[31] Financial statements failed to enumerate these compensation-motivated risks. Studies by the Securities and Exchange Commission,[32] the U.S. Senate,[33] and scholars reached similar conclusions.[34] [35]

Following the financial crash and the passage of Dodd-Frank without full implementation of the rules to rein in executive compensation, pay incentives continued to promote dubious banking practices. At JP Morgan, some of the largest paychecks go to derivatives traders. Some of these are employees who make bets on the direction of a financial metric, such as interest or exchange rates. At the end of 2012, JP Morgan deployed about $180 billion worth of deposits into trading, which the bank primly calls “other available-for-sale securities.” [36] These “other” securities, it turns out, include bets, that the bank dignifies with the term “derivatives.” Former Rep. Brad Miller (D-N.C.) observed that JP Morgan’s bets “had nothing to do with real credit. These derivatives trades did not make it possible for more businesses to buy equipment, pay overtime or hire new employees; no household was able to buy a new car or replace their furnace. Instead, the trades were “synthetic” credit, a bet on whether a borrower would default on debt to someone else.” [37] JP Morgan did well on some of these bets. For example, it bet that American Airlines would go bankrupt. When American Airlines did declare bankruptcy, JP Morgan realized a profit of $450 million. [38] [39] The traders earned handsome bonuses for this success. One trader made $11 million that year, and the trader’s [40] supervisor earned $14 million in that same period.[41]

In more recent history, some of JP Morgan’s derivative bets went awry in the case known as the “London Whale,” A handful of traders in JP Morgan’s London office handling that $300 billion in “excess cash” made mistakes. JP Morgan CEO Jamie Dimon initially dismissed the public discussion of it as a “tempest in a teapot.” Several months later and after more scrutiny, Dimon revised his outlook and called it an “egregious” mistake. [42] The bank lost more than $6 billion on the bets, and a U.S. Senate investigation later turned up evidence that an attempt to increase senior management compensation motivated the trades.

In “Exhibit 46” of the Senate report, JPMorgan’s chief investment officer directed subordinates to implement a plan to enable the bank to buy back stock. That plan depended on convincing regulators that such a step would be financially prudent. In a series of emails about the trades, the CFO stated she was “trying to work “ with the regulators on an “acceptable … increased buyback plan.” [43] In conventional terms, the committee report alleged that JPMorgan sought to manipulate how the “whale” trade would appear to regulators so that JPMorgan could buy back stock – an action that typically boosts a share price and thus leads to higher executive compensation.[44] [45]

High pay also figured in some questionable decisions by the CEO of OneWest, who surprisingly went on to become the nation’s chief bank police officer as Comptroller of the Currency. Hedge fund manager and now Treasury Secretary, Steven Mnuchin, purchased the failed IndyMac savings and loan association from the FDIC and renamed it OneWest. Mnuchin brought in a mid-level manager named Joseph Otting from US Bancorp to serve as OneWest CEO. Under Mnuchin’s ownership, the bank foreclosed on thousands of homeowners by using fraudulent methods: They fabricated foreclosure documents. They filed unnotarized documents with state and federal courts. OneWest’s regulator itemized these misdeeds, and under new CEO Otting, the bank signed a “consent order” acknowledging those misdeeds along with a promise to reform. However, the bank did not reform, and under Otting, OneWest affiliate Financial Freedom allegedly made false claims to the government for federal insurance and paid a $89 million penalty.[46] Otting’s bank put thousands of families out of their homes,[47] Which one judge deemed as “harsh, repugnant, shocking and repulsive” conduct.[48]

Otting and Mnuchin arranged to sell OneWest to CIT group for a profit, and it is worth noting that completion of the deal promised Otting a $24 million bonus. What stood in the way of his huge payout were protests by some of those thousands of families and other victims of OneWest’s practices.

Otting then became Comptroller. Otting’s visits to Capitol Hill for testimony also drew controversy.[49] He declared at one hearing that he’s never experienced or witnessed racial discrimination. Asked whether he watched or read the news about the Charlottesville white nationalist demonstration, he claimed that he doesn’t read newspapers or watch TV news.[50] Despite the foreclosures and violations, despite the protests of the merger, and despite the fact that CIT terminated Otting shortly after then merger, Otting nevertheless received his $24 million payoff.[51]

At yet another bank, Wells Fargo, compensation drove widespread fraud in many of its business operations, including checking accounts, credit cards, car insurance, investment accounts and more. One of the long-standing metrics for senior pay bonuses at the bank was account growth. Wells Fargo wanted its customers to have not one or two, but as many as eight (“go for gr-eight”) connections to the bank, such as a checking account, a credit card, a mortgage and more.[52] Wells Fargo reported these account connections, known as “cross-selling,” as a key indicator of how it could manage growth. When it acquired other banks, such as Wachovia, its employees faced pressure to show how those cross-selling numbers would continue to rise steadily. That satisfied shareholders who might otherwise have been concerned that growth might lead to management complications. And satisfied shareholders meant a rising stock price, and as a result greater senior management pay. Public Citizen documented this decades-long dynamic in “The King of the Cross-Sell and the Race to Eight.”[53] Internal whistleblowers alerted their superiors and eventually the media that much of these cross-selling figures were fabricated. Bank employees created fake accounts to meet quotas. Wells Fargo terminated many of these line employees, but senior managers nevertheless retained their bonuses. Eventually, the Consumer Financial Protection Bureau and the City Attorney of Los Angeles brought charges for these fabrications and leveled a record fine.[54] When greater scrutiny of the bank followed, even more abuses were revealed, and eventually, the CEO resigned. The fruits from this fraud, amounted to $130 million in compensation for the CEO, and millions more for other senior managers.[55]

Bankers are the poster boys for misbegotten pay. But they are not the only ones to cash in on these misplaced incentives.

Health Care

The U.S. health system costs four times as much to run as the system in Canada.[56] There is little debate that profiteering drives this expense. Part of that profiteering is the extraordinary CEO and senior manager pay in the health care industry. For example, the CEO of Regeneron Pharmaceuticals pocketed $118 million in 2018. The CEO of HCA Healthcare took in $109 million, the Pfizer CEO made $47 million, and the Humana CEO took in $27 million.[57] Just these singular annual payments are enough not only to secure a luxurious future for these CEOs, but also their offspring, with no need ever to work again. Yet these CEOs will undoubtedly receive similar windfalls in future years, as well. Below these CEOs are countless other senior executives who also receive millions of dollars annually. These are the routine paychecks financed by the high prices that average Americans pay for health insurance, co-pays and for care services.

In 2016, the U.S. spent 17.8 percent of its gross domestic product (GDP) on healthcare. Other countries’ spending ranged from a low of 9.6 percent of GDP in Australia to a high of 12.4 percent of GDP in Switzerland.[58] A sizeable amount of this difference in spending finds itself in the bank accounts of health provider business. Drug pricing, surprise billing and the opioid crisis demonstrate the problem of misplaced pay incentives in the health care industry.

Drug Pricing

The high cost of prescription medicines in the U.S. demonstrates how profiteering subordinates health care results. Since 1996, pharmaceutical corporations have increased the list price of a vial of insulin from $21 to over $275.[59] For example, patients with serious diabetes can pay $3,000 a month for insulin in the United States. In Canada, the comparable bottle of insulin costs $21.[60] Drug price gouging is all too common. Corporations abuse their monopolies to jack-up prices. As a Public Citizen commentary noted, “Pharma CEOs get rich, patients die rationing insulin.”[61]

In the notorious case of Martin Shkreli, who founded Turing Pharmaceuticals in 2015,[62] certain drug prices were raised a thousand-fold. Through Turing, for example, Shkreli purchased the rights to Daraprim. The drug had been developed decades before Shkreli acquired it, meaning Turing spent no money developing it. According to a congressional committee, he “purchased it for the purpose of increasing the price dramatically and making hundreds of millions of dollars by exploiting its existing monopoly before any competitors could enter the market.”[63] Shkreli’s motives were transparent. For example, on May 27, 2015, after progressing on the purchase of Daraprim, he emailed his board chair: “Very good. Nice work as usual. $1bn here we come.”[64] On August 27, 2015, Shkreli sent an email to another contact, writing: “I think it will be huge. We raised the price from $1,700 per bottle to $75,000 … So, 5,000 paying bottles at the new price is $375,000,000—almost all of it is profit and I think we will get 3 years of that or more. Should be a very handsome investment for all of us.” On Sept. 17, 2015, a senior Turing manager referenced a single purchase order for 96 bottles of Daraprim at $75,000 per bottle—an amount that nearly totaled the full annual revenues of the drug’s previous owner. She wrote: “Another $7.2 million. Pow!”[65]

Unfortunately, the problem wasn’t unique to Shkreli. Many companies follow a similar business model. Consider Allergan, for example, a corporation that has recently merged with AbbVie. A Public Citizen report noted that “[A] closer examination of the corporation’s record reveals a catalogue of abuses, showing just how deeply the pharmaceutical industry business model is broken” Allergan “has repeatedly used dubious tactics to boost profits — from paying off its competitors, to gaming the patent system, to hiking the prices of old medicines.” Recently, “Allergan has entered settlements for a billion dollars over its anticompetitive conduct and remains enmeshed in several other lawsuits, with possible legal exposure for billions more. Between 2006 to 2012, its former subsidiary sold 26 billion opioid pills, more than 80 for every American.”[66]

Critics, including the firm’s own shareholders, lambasted compensation plans for leading to these legal costs. One institutional investor highlighted the “stunningly excessive level of management compensation.”[67] One Allergan CEO was “lined up to receive $38.7 million in compensation” as a golden parachute, according to a media account. [68] In 2019, the CEO received $9.2 million in compensation. This included more than $6 million worth of stock options.[69] Stock option value follows the price of the stock, which increases with increased profits. The profits per share can be increased by reducing the number of shares, which Allergan accomplished through share buybacks. The board of directors, which approves executive compensation, is also paid, in part, in stock options. Approximately half of the more than $300,000 that each receives comes from stock-based compensation.[70]

A Senate committee investigated the Shkreli case as part of a broader problem with escalating drug prices.

Sen. Claire McCaskill, then a Democratic senator from Missouri, concluded: “What we’re seeing in these cases is Wall Street having turned its eye to healthcare because it has realized that here is a commodity, a product, with a stubbornly inelastic demand. Yes, there is a price for everything at which people will no longer be able to pay for a product. But what some investors have realized, much to their delight, is that they can keep squeezing the very people who depend on these drugs in order to line their own pockets. This is disturbing. If this new breed of pharmaceutical companies is where our pharmaceutical industry is headed, we are in big trouble.”[71] Shkreli was subsequently convicted for securities fraud (not related to raising drug prices) and sentenced to seven years in prison. [72][73]

Congress has investigated the connection between raising drug prices and winning greater executive compensation. For example, a Senate committee reviewed the connection between the pay of AbbVie Chairman and CEO Richard Gonzalez and the sales of its arthritis treatment Humira. Since 2014, AbbVie has nearly doubled the price of Humira. The drug now carries a list price of more than $60,000 per year. AbbVie has aggressively kept low-cost biosimilar competition off the U.S. market.”[74] In 2017, Humira generated $18.3 billion in sales, a 14.6 percent increase from the previous year. Humira sales accounted for about 65 percent of the company’s $28.1 billion in revenue. In turn, this increase factored in “the compensation for AbbVie’s top executives,” according to one account.[75] [76]

CEO Gonzalez received a total of $22.6 million for his performance in 2017, $4.3 million of which was his cash bonus. The rest of his compensation was base salary and a mix of stock, restricted shares and options. “This strikes me as problematic,” Sen. Ron Wyden, (D-Ore.), noted. “Would you make a smaller bonus if you dropped the price of Humira?” In response, Gonzalez acknowledged, “It is clear it would be a part of the evaluation.”[77]

Opioid Crisis

The opioid crisis emerged from similar profiteering by senior managers. Opioids are a class of strong, highly addictive painkillers. Before the 1980s, many doctors refrained from prescribing such sustained pain killers following surgeries, deciding that the patient would be better suffering some discomfort over the short-term rather than risk long-term addition to pain killers. Then the opioid industry began to promote so-called scientific studies claiming that the painkillers were not addictive.[78] [79] [80] It took decades before this industry link was identified and disinterested research debunked the finding.[81] As the Centers for Disease Control and Prevention (CDC) summarized, “In the late 1990s, pharmaceutical companies reassured the medical community that patients would not become addicted to prescription opioid pain relievers, and healthcare providers began to prescribe them at greater rates. This subsequently led to widespread diversion and misuse of these medications before it became clear that these medications could indeed be highly addictive.”[82]

But the faux findings were convenient to otherwise well intended caregivers. Private insurance favored opioid treatments over more expensive therapies. Explained one expert, “Most insurance, especially for poor people, won’t pay for anything but a pill.”[83] In addition to opioids distributed through doctor prescriptions, an illegal market developed.

In fact, opioids are addictive and are readily abused. In 2000, the CDC counted approximately 8,000 fatalities from opioid abuse. By 2010, this grew to nearly 20,000 annually. In 2017, the figure surpassed 45,000.[84]

Subsequent litigation laid bare the financial motivations behind the promotion of opioid sales by leading opioid manufacturers and distributors. The Sackler family, which owned Purdue Pharma, reaped generous rewards from the opioid crisis, notably its flagship brand OxyContin, which it introduced in 1996.

Even as the opioid crisis became widespread and well publicized, Sackler family members looked to capitalize further. For example, in 2011 Sackler “family members peppered the sales staff with questions about how to expand the market for the drugs.” One asked “if they could sell a generic version . . . in order to ‘capture more cost sensitive patients.” [85]

Explained one observer, “The pill is stronger than morphine and sparked the opioid crisis that’s now killing[86] more than 100 people a day in America and has spawned millions of addicts.”[87] The family had helped fund the faux science, and marketed the additive drug aggressively.[88] Said attorney Michael Moore, who led litigation against Purdue, “Greed is the main thing. The market for OxyContin should have been much, much smaller, but they wanted to have a $10bn drug and they didn’t tell the truth about their product.”[89] A group of senators concluded that Purdue’s opioid marketing campaign, which accelerated the epidemic, that has claimed an estimated 400,000 lives, grew from a “significant incentive bonus compensation for [the CEO] for achieving ambitious opioid sales targets.” The senators expressed concern that Purdue is using profits from selling more prescription opioids to reward high-level employees with massive bonuses. [90]

Eventually, litigation concerning the company’s role in the opioid crisis led the firm to declare bankruptcy. Even after that, high compensation did not abate. Even now, the congressional critics say this bonus culture persists. For example, the CEO of Purdue received a $1.3 million incentive bonus payment even though he “is a named defendant in multiple lawsuits, which allege he personally designed Purdue’s intentionally deceptive opioid marketing campaign.” The senators noted that “the payment is based on aggressive performance incentives similar to those used to encourage opioid sales.” In conclusion, senators investigating the company argued, “By maintaining the aggressive incentive plan for [the CEO], the Board is showing that it does not recognize the role the incentive program played in accelerating the opioid crisis into a national tragedy”[91]

Purdue is not the only company where pay fueled pill pushing. McKesson has been one of the largest distributors of opioids. Here, too, the CEO’s pay linked to hitting targets related to distribution metrics. Even in a year when McKesson faced litigation stemming from its role in the opioid crisis, the CEO received a $4 million bonus for hitting financial targets tied to distribution,[92] in addition to a retirement package of $159 million.[93] [94] Eventually, McKesson settled with the Department of Justice for $150 million on charges that it “failed to report suspiciously large orders of prescription opioids from its pharmacy customers,” according one account..[95] The firm “is also contending with more than 1,000 civil suits across the U.S. related to its distribution of controlled substances.”[96]

Unsafe Mine Conditions

On April 5, 2010, a massive explosion at the Massey Energy Upper Big Branch coal mine in West Virginia killed 29 miners. This was the deadliest mine disaster in 40 years. The tragedy followed identification of ongoing, major safety violations at the mine. For example, the Mine Safety and Health Administration (MHSA) reported that this mine “had ‘repeated significant and substantial [safety] violations’ in 2009 at 19 times the national rate.”[97] “These violations prompted 48 ‘withdrawal orders’ in which miners were immediately pulled from affected portions of the mine until the problems were corrected.”[98]

In the years that these safety infractions mounted, leading eventually to this fatal disaster, the Massey board awarded the CEO increased compensation. In 2009, Massey Energy CEO Don Blankenship was paid $17.8 million, a $6.8 million raise over the previous year and almost double his compensation package in 2007.[99] Blankenship also received separate compensation package valued at $27.2 million at the end of 2009. Blankenship’s pay was tied to production results—more coal with less expense that subordinated safety.[100] According to one MSHA inspector,[101] “Management engaged in aggravated conduct constituting more than ordinary negligence in that production was deemed more important.”[102] Blankenship was later convicted of conspiracy to avoid mine safety standards.[103]

The average annual wage of a coal miner in West Virginia is $68,000, according to the U.S. Bureau of Labor Statistics.[104]

Air Safety

Boeing unveiled the 737 MAX commercial jet in 2016, then won certification from the Federal Aviation Administration (FAA) in 2017. [105] In October 2018, one of the new aircraft operated by Lion Air crashed into the sea shortly after takeoff from Jakarta, Indonesia. Five months later, in March 2019, a 737 MAX operated by Ethiopian Airlines crashed after takeoff from Addis Ababa, Ethiopia. In both cases, all passengers and crew perished, numbering 346 in total.[106] Authorities grounded that model of plane after they determined that a built-in system caused theses planes to nose-dive unless pilots took preventive measures. Those preventive measures, however, were omitted from the flight manuals and crew trainings.[107] Investigators found other problems with the manufacture and government certification of the plane. For example, Boeing management itself played an oversized role in the approval process by the FAA.[108] These managers “prodded” the FAA to “speed the process.” Part of this included “minimizing MAX pilot transition training,” which “was an important cost saving for Boeing’s airline customers, a key selling point for the jet.” To speed the process, pilots trained on iPads rather than flight simulators.[109] A senior manager told Congress[110] that he warned management that “Boeing was prioritizing production speed over quality and safety.”[111]

Observers have explored the connection to executive compensation metrics. “Operating cost management” as well as “on-time delivery” figured as key drivers of the CEO bonus.[112] Rep. John Garamendi, (D-Calif) said to the Boeing CEO at a congressional hearing, “You have a systemic problem in your company. You are pushing profits over quality and safety.”[113]

On the Boeing board, which structured this CEO bonus plan that prioritized delivery speed and cost reduction, none of these directors were pilots or engineers by training. The most common qualification was a background in finance.[114] It is not clear how well equipped these directors were to understand, let alone anticipate, the mistakes leading to the 737 MAX crashes. However, they did approve their own pay, which was roughly $300,000 each, annually.[115] [116] Even with the fatal crashes and identification of operational deficiencies, the board awarded the CEO a $62 million final bonus. Relatives and acquaintances of crash victims said they were “sickened” by the payout. Said one, “He presided over a profit-obsessed corporate culture that led the company to cut corners.” Said another, “Boeing executives should be walking away in handcuffs, not with millions of dollars.”[117]

Cheating Investors

Senior managers have cut corners on mine safety, an airplane manufacture secured a bonus based on reducing costs rather than ensuring safety, bankers engaged in reckless banking to meet loan-making quotas, and drug makers hiked prices to increase the profits that were tied to their pay. Another way to meet a quota that increases one’s pay: lie. Managers might report sales that never were, or report reduced costs that did not occur. In other words, a manager might “cook the books.” Among the victims of book-cooking are investors who depend on authentic financial disclosures.

At the turn of the century, investigations uncovered book-cooking at dozens of companies, such as Enron, World Com, Global Crossing, [118] Tyco, Rite Aid, Adelphia, and others.[119] These fraudulent efforts led to a rise in stock prices, generating bonuses for senior managers. In the year before its collapse, Enron paid $681 million to its 140 top managers.[120] This included $67 million to the CEO, and $47 million to the chief financial officer. Both were later prosecuted.[121] But investors eventually lost everything, buying stock at a price in accord with the fabricated results, only to watch the stock price plunge once those results proved illusory.

Compensation apparently blinded the Enron board. “Despite their apparent lack of diligence, Enron board members paid themselves compensation that was among the highest offered to any corporate directors in the country,” concluded a government report. “Their compensation . . . was valued in 2000 at approximately $350,000 per director—more than twice the national average.” Said one expert, “All of this remuneration may have compromised the directors’ objectivity with respect to management.”[122]

Wall Street analysts who might have questioned the surprising results at Enron and other high-flying companies were also compromised by compensation schemes that incentivized cheerleading over criticism, according to a Senate report. For example, their firms sought to retain business relations with the very firms the analysts covered, so they received little benefit for criticizing them, and reward for praising them. [123]

At Tyco, two senior officers were indicted on charges that they reaped $600 million through a racketeering scheme involving stock fraud, unauthorized bonuses and falsified expense accounts.[124]

For investors, cheating cost them value. In the case of Enron and other firms that declared bankruptcy, the losses were total. The Enron employees who invested in the company stock also lost. [125] At Tyco, the stock price collapsed from $63 at the height of its accounting frauds to $7.[126]

High pay goes hand-in-glove with book-cooking. One analysis of senior officers at 23 companies under investigation for accounting fraud found they received substantially more compensation during the three years before the government opened these cases than the average CEO at large companies. The average CEO pay was $62.2 million during for these three years, 70 percent more than the average CEO pay for large companies.[127] Following exposure of the frauds, the investors suffered, and as those executives pocketed a collective $1.4 billion, the share value of their firms declined more than 70 percent, erasing $530 billion from investor savings.[128]

Compensation figures as a motivation for fraud across all companies. One review of all fraud enforcement actions by the SEC during a 10 year period found that a manager’s wish to increase compensation served as the most commonly cited motivation to falsify results.[129] The Public Company Accounting Oversight Board also found the same link, noting that “incentives and pressures for executive officers to meet financial targets can result in risks of material misstatement to a company’s financial statements.”[130]

Stock Buybacks

Short of cooking the books, senior managers whose pay is linked to the stock price can line their pockets by arranging for the repurchase of their companies’ shares. When stocks are bought back, the same earnings are allocated to a fewer number of shares, leading to the value and price of each of these shares increasing along with stock-based manager compensation. On the surface, a stock buyback represents a declaration of management indolence. Firms issue stock to raise capital for growth, for the expansion of existing production, or for the research and development of new products. When managers repurchase stock, they are confessing they have no new promising ideas in which to invest. Paradoxically, stock buybacks reward these lethargic executives since they raise the stock price for managers who are paid in stock options. In other words, even though the managers have not developed a better mousetrap, they secure the same bonus as if they had.

The 2017 Trump tax giveaway law[131] generated a windfall for all American corporations by cutting the corporate rate by 40 percent. Trump officials claimed corporations would trickle down profits by investing these new proceeds into more company assets, including higher worker pay. Trump claimed the bill would generate an annual average pay raise of $4,000.[132] Treasury Secretary Steven Mnuchin also claimed the increased economic vitality would generate enough new tax revenue that the tax cuts would pay for themselves. Unsurprisingly, one of this proved true.[133] [134]

In the first quarter of 2018 alone, with the new tax law fully in force, American corporations bought back a record $178 billion in stock.[135] During this period, the market hit record highs. When a corporation buys stock, it should be governed by the maxim that applies to any investor: buy low, sell high. Yet because this frenzy of corporate stock buybacks happened when the market was at a record high level, it contradicts any claim that they were sound business decisions.

Still worse, Commissioner Robert Jackson of the SEC found that corporate insiders were inexplicably active sellers following a buyback announcement,[136] buttressing the concern about possible manipulation. Commissioner Jackson observed,

“There is clear evidence that a substantial number of corporate executives today use buybacks as a chance to cash out the shares of the company they received as executive pay. We give stock to corporate managers to convince them to create the kind of long-term value that benefits American companies and the workers and communities they serve. Instead, what we are seeing is that executives are using buybacks as a chance to cash out their compensation at investor expense.”[137]

In the CARES Act, Congress approved more than $500 billion in funds for corporate America in the hopes that they would retain employees through the shutdown. These funds were necessary, proponents explained, because these companies lacked the reserves to keep workers on the payroll. Had these same firms not engaged in a spree of buybacks just in the last three years, they might need taxpayer help. In the last three years, companies in the S&P 500 repurchased $2 trillion worth of their own stock.[138]

Cutting Jobs

In some cases, CEOs might attempt to meet compensation-based goals by terminating the employment of their workers.

One study found that CEOs receiving compensation below their peers are “significantly more likely to announce layoffs in the subsequent year, relative to those receiving compensation above their peers.”[139] CEOs paid at least 34% less than their peers each year were four times more likely to order layoffs the following year, researchers found. Among the firms that engaged in layoffs during the study period, the average initially “underpaid” CEO eliminated 1,200 jobs, affecting an average of 7% of employees. As a result of the layoffs, these “low-paid” CEO’s total compensation increased at an average of $600,000 in the following year. [140] Complementing this finding, another study found that CEOs of the 50 firms that have laid off the most workers since the onset of the economic crisis in 2008 took home 42 percent more pay in 2009 than their peers at other large U.S. companies.[141]

When Sears announced one mass layoff of 50,000 workers, the CEO accepted a 200 percent pay hike.[142] AT&T continued layoffs even as it amassed record profits, supercharged by the Trump corporate tax giveaway. [143] After terminating 12,000 workers following the tax cut, the AT&T CEO received $29 million in compensation that year.[144] Bank of America cut 5,000 jobs, also after the Trump tax cut.[145] Bank of America’s board awarded the CEO $26.5 million in compensation, a record for the firm.[146]

Rewarding Mismanagement

In addition to awarding high pay for reckless banking, subverting health care, and the manufacture of unsafe medicines, some executives receive astonishing pay for failing spectacularly. In 2019, the bosses of Adam Neumann decided it was worth paying him $1,700 million not to continue work at the firm he founded, a real estate venture called WeWork. WeWork provides shared workspaces for technology startups. At its peak, the firm maintained 280 locations in 86 cities across 32 countries. As a privately held firm, its financial results were not public. When Neumann announced WeWork would sell its shares to the public, it claimed a valuation of $47 billion. But when it released its financial statements, it showed persistent losses, including a $2 billion loss in 2018. This stemmed from “series of poor and avoidable decisions” by Neumann. Noted Sen. Tom Cotton (R-Ark), WeWork “just laid off 2,400 workers at Christmas, 20% of its workforce, due almost entirely to the incompetence, greed, and possible fraud and crimes of WeWork’s founder, Adam Neumann.”[147] Its biggest private investor decided it was worth paying Neumann $1.7 billion to separate him from the business.[148] [149]

In the 1990s, Walt Disney Corp paid Michael Ovitz a similar golden parachute to leave the entertainment colossus. The firm paid him $100 million for ceasing his contributions to the company.[150]

A UnitedHealth CEO who’d “improperly” handled the firm’s stock options, was paid $285 million to stop working for the firm. Board directors dissatisfied with a Home Depot CEO paid him $223 million to retire. A CVS CEO who exposed the firm to a Federal Trade Commission investigation received $185 million to leave the company.[151]

Overpaid, underperforming CEOs aren’t uncommon, even if they aren’t forced out of their company. In 2015, the corporate responsibility non-profit, As You Sow, began publishing annual reports documenting this persistent perversion.[152] For example, in a recent report, it found that Fleetcor overpaid its CEO by 263%, compared with S&P 500 CEOs who produced the same level of performance. Shareholders appeared to agree with the As You Sow findings, with 86% voting against his pay package, [153] [154]

Looting by Private Equity

Private equity (PE) partners, or Wall Street financiers who purchase companies, have caused damage to sectors beyond the health care industry discussed above. Critics claim that the private equity business model is to strip assets from companies that they acquire and then ransack. In many cases, the private equity partners make money personally even when their investors may lose, and their target firms declare bankruptcy.

In the year before PE consortium KKR, Bain Capital and Vornado bought Toys ‘R Us, the firm reported profits and was valued at $7.5 billion. But the financiers loaded the firm with debt and drained the firm with PE management fees. Eventually, Toys ‘R Us declared bankruptcy. That wiped out the investment clients of the PE consortium, and reduced the value of debt for the lenders. (Thousands lost their jobs.) Observers noted, however, that the consortium “managed to make money despite not creating – and, in fact, destroying – value.” Some of this came from $185 million in “advisory services” paid to the consortium. In addition, the three companies collected $8 million in “expense fees,” $128 million in “transaction fees,” and $143 million in interest on loans they had made to Toys ‘R Us. The total from these various fees, despite the bankruptcy: $464 million.[155]

Toys ‘R Us is not the only retail chain that has been a conspicuous PE victim. Since 2015, seven major grocery chains bought by PE firms, collectively employing more than 125,000 workers, have filed for bankruptcy. The bankrupted PE-owned grocery chains include A&P/Pathmark, Fairway, Tops, Fresh & Easy, Haggen, BI-LO, Bruno’s, Winn-Dixie, Fresco y Más, Harveys, and Marsh Supermarkets. During this period, no comparable publicly traded grocery chains declared bankruptcy. [156] During a ten-year period, retail firms bought out by PE accounted for a net 597,000 job losses, while the total retail sector added more than one million jobs.[157]

Because private equity firms are private, they are not subject to public disclosure of payments to senior managers. Generally, managers collect 2 percent of the funds under management, and 20 percent of any profits generated by the investments.[158] [159] When their investments go bust, bankruptcy documents reveal that the PE firms can profit. For example, one PE firm bought grocer, BI-LO in 2005 in a leveraged buyout, meaning the purchase was essentially funded after the change of control by requiring the grocer to take on debt to repay their investors. This ran the company into bankruptcy by 2009. After negotiating reduced payments to its creditors, the firm emerged from bankruptcy in 2010. After failing to sell the firm again, the PE firm loaded the company with more debt, using the proceeds to pay itself dividends. From 2011 to 2013, those dividends totaled $839 million. After a few more fee-generating moves, such as forcing the sale of real estate to insiders and then requiring the grocer to pay inflated rents, the grocer entered bankruptcy again. [160] As one critic concluded, “Is it possible for a private equity fund to make money without creating value?”[161] Or, “if company they have starved of resources goes broke, they’ve already made their bundle.”[162] [163]

Pay Gaps Exacerbating Income Inequality

Some economic phenomena are so obvious they are visible from space—think of how dark North Korea appears in nighttime satellite photos, evidence of its lack of development. Similarly, the steady concentration of income and wealth with senior managers has hollowed out the middle class and impoverished those already at the bottom in dimensions clear from any graphic.

As noted above, the fruits of productivity, as defined by wages, from World War II to the early 1970s was spread evenly among workers. Since the 1970s, that changed. Productivity continued to increase; workers produced more value for each hour worked. But the fruits of that labor did not go to average workers; it went to senior managers, namely the 0.1 percent at the top.[164]

In 2018, the wages of all America’s 144 million workers totaled $7.3 trillion. The top 5 percent, or 7 million workers, received $2.1 trillion, or nearly a third of all wages received by all Americans. That means the best paid person out of 20 received almost a third of all the wages.[165] The best paid 1 percent of Americans earn more than 20 percent of all income.[166]

Concentration of wages at the top also allows the best earners to invest and make even more money. According to the Urban Institute, from 1963 to 2016, families near the bottom of the wealth distribution, that is, those in the lowest 10th percentile of wealth, went from having no wealth on average to being about $1,000 in debt. Contrast this with families near the top, with more wealth than the other 90 percent, who enjoyed a fivefold increase in their wealth. Those in the top 1 percent experienced a seven-fold wealth increase.[167]

Most Americans have no savings, no investments, and therefore make no money from investments. Investment income for the richest 10 percent makes up about 20 percent that group’s income. Half of all stocks are owned by the richest 1 percent of Americans.[168]

In 1963, families near the top (99th percentile) held six times the wealth ($6 for every $1) of families in the middle. By 2013, top families had 12 times the wealth of families in the middle.[169] For the top 1 percent, investments generate about 30 percent of income, a sizeable amount, but the major source of income for this elite remains their salary.[170] In short, siphoning the fruits of productivity growth into the c-suite instead of giving workers increased wages that they earned has led to exacerbated income inequality

What’s wrong with income and wealth inequality? The rich have always been richer than the poor. Why do worsening trends in inequality matter? The problems are many. Massive gaps in income inequality insult basic fairness. The goal is not to keep people from getting rich. The goal is that rich people should not be rich because working people are paid less. Studies show a correlation between income inequality and higher crime rates,[171] especially in the face of conspicuous consumption by the rich.[172] Studies across countries affirm the connection between crime and inequality.[173] Other researches find bad health outcomes in areas with high income inequality.[174]

Finally, income and wealth inequality are bad for the economy, even for the rich. Under diminishing marginal utility theories, simply put, if income clots with the few at top, they simply can’t spend all that money—circulate it—in the economy. There is only so much haute cuisine they can consume in a day, only so many palaces that can be inhabited each day, only so much entertainment that can be enjoyed at a time. Studies affirm that income inequality leads to stagnating economic growth. [175][176] Explained one scholar, “If you’re a billionaire owner of a retail or manufacturing company, you want people to be able to afford the stuff you’re selling. Henry Ford offered his workers high wages not out of any altruistic impulse but because he wanted them to buy his cars.[177]

Exploiting the Pandemic

The spring 2020 voluntary shutdown of the American and global economics tore the scab off the wound that is income inequality. Nearly half—about 40 percent—of American adults wouldn’t be able to cover a $400 emergency with cash, savings or a credit-card charge that they could quickly pay off, according to a Federal Reserve survey.[178] About 27% of those surveyed would need to borrow the money or sell something to come up with the $400, and an additional 12% would not be able to cover it at all, according to the report.[179] This meant that many of the millions of people now without a job could not afford basics—grocery, utilities, medicine, rent. Congress responded with a series of laws granting funds to people. Of course, this swells the budget deficit that must be repaid and/or financed for generations to come.

Meanwhile, profiteers scavenging the battlefield appear inevitable. In early May 2020, two men from New England become the first people charged in the United States with fraudulently applying for aid from the Payroll Protection Program (PPP), a part of the CARES Act. The PPP is designed to help small businesses retain employees when they lack normal business because of the coronavirus pandemic shutdown. The two allegedly claimed to “have dozens of employees earning wages at four different business entities when, in fact, there were no employees working for any of the businesses,” the Justice Department said.[180]

Drug companies are particularly well positioned to profit. In early July, 2020, drug-maker Gilead today announced that 7mdesivir, a drug approved to treat COVID-19, will be priced at $3,120 for a typical patient with insurance.[181] Public Citizen previously found that public financial support for Remdesivir’s development totals at least $70.5 million[182] through federal grants and clinical trials, and has pushed for Gilead to price the treatment at $1 per day.[183]

Some of the questionable activity takes place in plain view. Many publicly traded firms with access to capital markets nevertheless applied for and accepted PPP funds. Shake Shack took $10 million before returning it. Auto Nation took $77 million, Ashford Hospitality Trust took $45 million and others took millions, many of them keeping the funds.[184]

The Federal Reserve has retained BlackRock, the world’s largest asset manager, to facilitate some of its interventions. This raised questions that the Congressional Oversight Commission (COC), one of the few safeguards in the CARES Act meant to ensure the money goes where intended, should address. For example, BlackRock contracted with the New York Federal Reserve Bank to provide management and advisory services to the facility. The COC noted, “In that role, BlackRock employees will have access to material non-public information. Per the contract, certain BlackRock executives with access to that information will have the ability to provide “investment management, trading, and/or advisory services to other clients with respect to securities. . . . They are also permitted to provide ‘investment management, trading or advisory services’ in any asset class and to purchase investments for themselves in any asset class after a two-week cooling-off period.” The COC asked: “Why is two weeks an appropriate cooling-off period? How will any breaches of the non-public information be reported? What will be the discipline for such breaches?”[185]

In sum, the damages wrought by misbehaving managers, arguably in pursuit of lucre, are vast and span virtually all industries. Bad pay practices cost lives, mean social chaos, and must be reformed.

II. Reforming Pay

To confront the myriad ills of incentive plans that cause income concentration to senior managers which leads to widespread misconduct, the next Congress and president must adopt an ambitious agenda of reform. Fortunately, many members of Congress and a number of presidential aspirants have floated responsible, sensible solutions.

Reforming Corporate Pay Rules

Because of the tie between executive pay and financial industry risk-taking, the 2010 law passed in the aftermath of the crash that caused the Great Recession, namely, the Dodd-Frank Wall Street Reform and Consumer Protection Act, (Dodd-Frank) put in place some protections to limit the harm from executive pay packages. But they were but the first step, and Congress should mandate additional reforms.[186]

Say-on-Pay Director Accountability

Under Dodd-Frank’s Section 951, corporations must seek a shareholder vote on compensation packages for CEOs. Unfortunately, the current vote is non-binding, meaning that even if most shareholders disapprove, no changes are required. Because of the limitations of Dodd-Frank, Congress must require that say-on pay votes be binding. In addition, there should be an additional prod to ensure good pay packages. Where shareholders oppose the package, the pay should revert to 20 times the median pay at the company, and director compensation should be cut in half, a concept promoted by economist Dean Baker. We also propose following the model pioneered in Australia, where if 25 percent of shareholders oppose the pay proposal two years in a row, the board must stand for re-election.[187]

Real Shareholder Choice of Board Members

Directors set executive pay, yet these directors don’t necessarily reflect shareholder interests since there is no true election; shareholders only vote on one set of candidates. We propose a ballot that shows multiple candidates for each position.[188] A shareholder or group that holds $50,000 worth of stock in a company should be able to nominate at least one candidate. The SEC has proposed to allow owners with 3 percent of the shares to submit a limited number of candidates, however that is far too high a level at most large companies, for example, it would require holders of Apple Inc.to own $3 billion worth of stock.[189] Average investors need a mechanism to promote director accountability.

Worker Boards of Directors

Sen Elizabeth Warren (D-Mass) has introduced the Accountable Capitalism Act, which requires corporations with an annual revenue of more than $1 billion to allow employees to pick at least 40 percent of board members.[190] In a recent poll of likely U.S. voters, 52 percent were supportive of putting workers on boards of large corporations and only 23 percent were opposed.[191] Sens. Tammy Baldwin (D-Wis.) and Cory Booker (D-N.J.) have advanced similar proposals.[192] In at least a dozen European countries, workers have the right to representation in their company’s top administrative and management bodies. This has had a moderating effect on CEO pay levels. In Germany, which has one of the most highly developed systems for including workers in corporate decision-making, average CEO pay levels, while hardly stingy, were less than half the U.S. average in 2016, according to Bloomberg.

Reform Stock Buybacks

Buybacks drain capital that could be used for better employee pay or other investments in physical assets. Before an SEC rule change in the 1980s, buybacks were rare, but now they are an engine of escalating CEO pay.[193] Baldwin promotes the Reward Work Act which bans buybacks altogether. It also requires that a third of board members be elected by a firm’s employees.[194] A bill authored by Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calfi.) would prohibit buybacks where CEO pay exceeds 150 times that of the company’s median pay. Senators Cory Booker (D-N.J.) and Bob Casey (D-Pa.) have introduced the Worker Dividend Act that requires companies that buy back stocks to also pay out a commensurate sum to all of its employees.[195] The SEC should require that shareholders approve buybacks, rather than directors.[196] Finally, Congress should simply ban executive stock sales during buybacks altogether.

Defer Pay and Use it for Corporate Penalties

Following the 2008 financial crash, the Justice Department found widespread fraud. However, prosecutors brought no charges against any senior individuals. Some officials cited the complication of identifying culpable individuals but that left shareholders to shoulder the fines. To improve compliance we call for the system advocated for by Willian Dudley, then president of the New York Federal Reserve, which says that senior bankers (such as the 2,000 most senior at JP Morgan) must defer a substantial portion of pay.[197] If the bank must pay a penalty, this pool is used to pay the fine instead of shareholder funds. This will motivate managers to police one another.

Rep. Katie Porter (D-Calif.) sponsors a bill that calls on all corporations to sequester a portion of compensation for their top five officers (or explain to shareholders why they do not).

No Stock Options for Bankers

Structuring pay to motivate executives to take risks may be healthy for some firms, but it can lead to disaster at banks. Bankers should not be paid in stock options. The European Union introduced rules in 2014 to limit banker bonuses to no more than their annual salaries, or up to 200 percent of annual salary with shareholder approval. The cap applies to bankers in non-EU banks located in the EU, as well as senior staff (including Americans) working for EU-based banks anywhere in the world. This reform aims to help counter the “bonus culture” that encourages high-risk investing. European regulators are working to crack down on some banks that have been circumventing the new rules by raising base salaries and converting bonuses into “allowances.”

Here in the U.S., banker stock options should be banned. Short of that, they should be limited as done in the EU. Or, they should at least be kept (and not cashed in) for at least two years after retirement. This deters banking that yields short term profits at the expense of long-term problems.

Ratio-linked Pay for Government Contracts and CARES Act aid

Policymakers should use the power of the public purse to incentivize narrower pay gaps. Congress should ban contracts to corporations with extreme gaps or give preferential treatment to firms with narrow gaps, as proposed in Rhode Island.[198] [199] Similarly, all corporate welfare programs should be required to incorporate pay ratio guidelines in their qualification standards. As a member of Congress, Rep. Mick Mulvaney (R-S.C.) authored an amendment designed to prevent the U.S. Export-Import Bank from subsidizing any U.S. company with CEO pay greater than 100 times median worker pay.[200]

The prodigious aid granted by Congress under the CARES Act during the pandemic should come with strict restrictions on executive pay. A House Financial Services Committee draft capped CEO pay at aided firms to 50 times the median pay at the firm.

CEO Pay Limit for Firms in Bankruptcy

Executives should not be able to pocket huge bonuses after declaring bankruptcy and cutting jobs and pensions. Policymakers should eliminate loopholes in existing law and prohibit companies in bankruptcy from awarding “retention” bonuses.[201] For example, a senior executive should not be paid a bonus unless the executive is offered the same or higher pay from a potential new employer.

Private equity executives should not be allowed to take companies into bankruptcy and simultaneously terminate employee pension benefits as a means of increasing their personal pay. These executives should be barred from receiving any pension or pension-like benefits unless pensions and severance funds for the workers of the operating companies are fully funded.

CARES Act Conditions

When Congress approved the $2.3 trillion CARES Act, it contained essentially no conditions on senior executive pay. It required only that certain airline and other executives limit their compensation to $3 million and half of the amount above this $3 million they received in 2019. [202] There are no limits on pay for executives at other aided firms.

Nearly 60 organizations have petitioned Congress for limits. CEOs of aided firms should receive no more than 50 times the median of their employees’ pay. Senior executives should have a sizeable portion of their pay sequestered for a “penalty pot.” If the firm is found to have abused the aid or engaged in misconduct that requires it to pay a penalty, taxpayers should not subsidize that penalty; the penalty pot from deferred executive compensation would be used. This deputizes all senior executives to police one another, since misconduct by any will impact them all. Further, buybacks should be banned, corporation deductions for pay to any individual of more than $1 million should be prohibited, and re-pricing options should be prohibited. Re-pricing is where the original price where a bonus kicks in is lowered, such as in a major stock dip.[203] More than 100 House Democrats have called for similar reforms.[204]

Reforming Pay Through Tax Laws

The tax code should not encourage excessive CEO pay while enabling wage growth to be stifled for workers.[205] There are many ways to address this problem.

Ratio-linked business tax rates

Sen. Bernie Sanders (I-Vt.) and Rep. Barbara Lee (D-Calif.) have sponsored legislation that would raise corporate tax rates when the ratio of pay between the CEO and median paid worker at a firm exceeds certain thresholds. Dodd-Frank required that all publicly traded firms disclose the median pay, and the CEO’s pay as a multiple of the median pay. The Tax Excessive CEO Pay Act would prompt corporations to curb high pay gaps by imposing graduated taxes on top of the standard corporate rate for companies that pay their CEO more than 50 times the pay of the median worker. The tax penalties would begin at 0.5 percentage points and rise to 5 percentage points for firms compensating their chief executives at more than 500 times the rate of their workers. A recent report by the Institute for Policy Studies found that 80 percent of S&P 500 firms paid their CEOs more than 100 times the pay of their median worker. Explained Sen. Sanders, ordinary workers at some of the richest corporations are making “poverty wages” while corporate CEOs make “hundreds—sometimes thousands—of times more.” “The last time I checked, corporations got by just fine when CEOs made a million bucks a year—one-tenth of what they make now. . .. . If America’s corporate boards can’t understand the absurdity of paying their CEO friends—in one year—more than their workers will earn in a lifetime, then the Tax Excessive CEO Pay Act will help them figure it out.” [206] [207] Already, the city of Portland, Oregon imposes a similar tax on firms that do business in the city.[208]

Excise Tax on Excessive Pay

Former CEO and corporate board veteran Steven Clifford proposes a 100% tax on any pay beyond $6 million.[209] An excise tax can best restrain outrageous CEO pay.[210] The concept enjoys bipartisan support, and the recent Republican tax bill imposed a 21% excise tax on CEO and other executive pay above $1 million at non-profit organizations.[211] [212]

A variation would be to impose such a 99 percent excise tax on any pay above 20 times median pay, a ratio advocated by management expert Peter Drucker.[213] Firms with median pay of $50,000 could pay their CEO $1 million without having to pay the tax penalty. These rates are higher than those proposed by leading progressives such as Rep. Alexandria Ocasio Cortez (D-N.Y.) She would leave the current tax rates intact until the individual took in more than $10 million. Beyond $10 million, the individual would pay 70 percent of this in tax.[214]

Some point to the generous philanthropy of America’s wealthiest as a reason not to impose taxes on executives. While they may not be paying high taxes to the government, they are nevertheless providing support that benefits the public. In fact, the philanthropy of the richest represents a modest share of their net worth. In 2018, Jeff Bezos, America’s richest citizen, donated 0.1 percent of his wealth; Bill Gates, the second richest, contributed 2.6 percent; Warren Buffett 3.9 percent; Mark Zuckerberg 0.7 percent; Larry Ellison 0.0 percent. The balance of the richest 20 Americans averaged less than 0.5 percent.[215]

Limit Deduction of Pay Exceeding $1 Million

In 1993, Congress limited the deduction publicly traded companies can take for compensation paid to their five senior executives to $1 million unless pay beyond this threshold is tied to performance plans approved by shareholders. In the 2017 tax giveaway law, in order to lower the total cost of the package, the performance provision of this law was eliminated, demonstrating Republican support for closing this loophole. However, the limitation still only applies to the top five executives. From here, we should expand this deduction limit to all employees paid more than $1 million, at both public and private companies that pay corporate taxes. (Some private companies’ owners have chosen to “pass through” income, meaning they pay tax at the individual rate and not as a corporation.) At major banks such as JP Morgan, more than 2,000 individuals are paid more than $1 million. Sens. Jack Reed (D-R.I.) and Richard Blumenthal (D-Ct.), and Rep. Lloyd Doggett (D-Texas) have sponsored legislation that would generate an estimated $40.7 billion over 10 years.[216]

Cap CEO Pay at Nonprofit Organizations

Under the 2017 tax law, nonprofits that are subject to taxes may no longer deduct executive compensation above $1 million off their federal taxes. This is a positive step, but more could be done to ensure that taxpayers are not subsidizing excessive pay at these organizations, which already received preferential tax status. Economist Dean Baker has proposed for nonprofits to pay their executives less than $400,000 per year (the salary of the U.S. president) as a condition of keeping nonprofit status for tax purposes. Another approach would be to set the cap at no more than 20 times the pay of the organization’s lowest-paid worker.

Reforming Private Equity Monitoring Fees

As explained above, many thriving major corporations are taken private by leveraged buyout firms (LBO, or private equity firms). These LBO firms replace the equity with debt, and then drain the firm with so-called monitoring fees.[217] At the very least, these monitoring fees should be treated as non-deductible dividends when private equity firm partners are filing their taxes. Sen. Elizabeth Warren’s “Stop Wall Street Looting Act,” (drafted with input from Public Citizen) would robustly reform private equity monitoring fees along with addressing other problems private equity brings to investment transactions. For example, private equity partners would not be able to pay themselves any dividends from any acquired company for two years after the transaction. Also, the partners would be responsible for repayment of some of the debt should they lead a target firm into bankruptcy. [218]

Union Rights

As noted in the beginning of this report, the laws and protocols governing union organizing and collective bargaining have eroded in the last century. Management can intimidate workers who might otherwise join a union with little chance for recrimination.[219] Many states have “right to work laws,” allowing workers to enjoying the benefit of union-won wages and benefits without joining the union and paying dues. As a result, union membership rolls have dropped.

Ancillary laws must also be passed, such as making it easier for workplaces to unionize, such as passing legislation that allows a union to be certified once a majority of employee signatures have been obtained. Yes, many firms have outsourced work to low wage countries. But the concentration of income at upper levels of management from the diversion of gains from productivity shows that there is ample room from current, domestic enterprises to pay better wages to average workers.

The Taft-Hartley Act, dubbed the “slave labor bill” by President Truman, whose veto the Republican Congress overrode, banned secondary boycotts, where the union might ask supporters to boycott a supplier or purchaser from the firm that is the primary problem for the workers. It outlawed closed shops, where a firm could only hire union members.

To return to fairer organizing law, in the last two decades, unions have promoted the Employee Free Choice Act. The bill would permit a union to gain a certification as the authorized union to negotiate with an employer if the union officials gather signatures of the majority of the workers. The Employee Free Choice Act would remove the current power of the employer to request a supplementary, distinct ballot where more than half of the employees have given their signatures already supporting the union.

The bill would also require employers and unions to go into binding arbitration in order to produce a combined agreement within 120 days after a union has gained a majority of worker signatures. The Employee Free Choice Act would stiffen penalties on employers who discriminate against workers that express support for a union.[220] [221]

Conclusion