Empty Promises

Despite parading itself as a champion of 3 million businesses, the legal advocacy of the Chamber of Commerce continues to contradict its own assertions.

By Zachary Brown

Introduction

The U.S. Chamber of Commerce (hereinafter, “the Chamber”) is well known for its work representing corporate giants, and for its deployment of direct lobbying efforts, having spent over $1.8 billion on lobbying since 1998.[1] A much lesser-known weapon of the Chamber’s advocacy arsenal is worthy of further inspection: the Chamber’s litigation work, specifically the U.S. Chamber Litigation Center.[2]

Through the U.S. Chamber Litigation Center, the Chamber regularly uses its legal resources to put its thumb on the scale in a variety of legal disputes, not only serving to protect the interests of some of the largest business conglomerates in the world, but also utilizing the courts in an attempt to push its own interpretation of how the world around us should operate in regard to environmental protections, labor rights, taxes, and consumer safeguards.

Methodology and Key Findings

In order to provide a more complete view of the Chamber’s litigation strategy, Public Citizen’s Chamber Watch examined 400 of the Chamber’s most recent cases utilizing the U.S. Chamber Litigation Center’s online archive. The archive is organized in roughly reverse chronological order according to filing date for pending cases and resolution date for decided and settled cases. The sample of 400 cases examined covers roughly the 5.5-year period from January 2018 to July 2023. Our analysis looked at the court in which each case was filed, the role played by the Chamber, the legal issues raised, and the identity, size, and the fiscal revenue of the litigants supported.[3]

We also took a close look at a few of the most impactful interventions the Chamber made over the past few years, and the message is abundantly clear: in these cases, the Chamber’s big business interests came first over the interests of small businesses and everyday Americans.

Our results can be summarized as follows:

- Of the 400 cases analyzed in this report, the Chamber backed Fortune 500 litigants 35% of the time. It backed big businesses outside of the Fortune 500 – those with revenue of more than a billion dollars – an additional 20% of the time. Thus, the majority of the Chamber’s litigation activity supported large corporations.

- In comparison, the Chamber filed in support of at least one small business[4] only 6% of the time. Accordingly, only 23 of the roughly 28 million small businesses in the U.S. (0.0001%) directly benefited from the Chamber’s litigation.

- A key issue addressed by the Chamber is restricting access to the courts, defined for the purposes of this analysis as issues relating to arbitration and/or class actions. By working to close the courthouse door on potential litigants who have been harmed, the Chamber continues to work for the benefit of big businesses that aim to shield themselves from being held accountable to consumers in the courts.

The United States Chamber of Big Commerce

The Chamber of Commerce holds itself as the representative of American business writ large, and it puts a particular emphasis on its work on behalf of small businesses, especially in its communications and lobbying activities, where it makes frequent mentions of the “mom and pop shops” and small businesses whose interests it claims to represent.[5],[6] If this were true, the numbers should show a more active legal presence stepping in to legally aid small businesses.

But of the 400 cases we examined, the Chamber’s litigation supported one or more small businesses[7] in only 23 cases, or 6% of the time. By way of comparison, the Chamber’s litigation directly supported only 23 of the estimated 28 million small businesses in the U.S., or 0.0001%.[8]

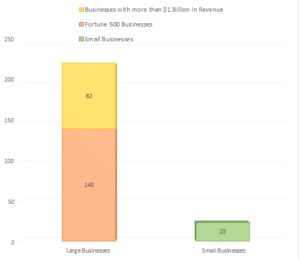

On the other hand, the Chamber supported a Fortune 500 (either global or U.S.) company[9] in 140 cases, or more than a third of the time. [See Figure 1] Additionally, another 82 cases involved corporations or organizations raking in over $1 billion per year in revenue. Thus, more than half the time, the Chamber’s litigation supported large corporations.

Figure 1: Chamber of Commerce Supports more Multinational Corporations than Small Businesses*

*Businesses/organizations falling outside of these categories are not represented in the above graph.

The Chamber’s Litigation Goal: Close the Courts to Consumers

Of the 400 cases analyzed for this study, the Chamber litigated a total of 76 cases where access to the courts was one of the primary legal issues involved [Figure 2]. For the purposes of this study, we defined “court access” as including legal disputes relating to whether or not forced arbitration clauses would be enforced and whether or not a class action lawsuit would be allowed to proceed.

And while the Chamber actively works to shut the door on everyday Americans seeking relief from the judicial system, the Chamber certainly had no issue availing itself of the Court. Recently, Chamber of Commerce President and CEO Suzanne Clark utilized the yearly State of American Business Address to boast about the organization’s many misguided accusations of overregulation, stating: “And that’s why the Chamber sued the FTC, the SEC, and the CFPB, last year.” The Chamber President even goes so far to declare that the organization’s goal is to “bolster America’s strength through the rule of law.”[10] This claim is directly contradictory to the work of the Chamber to reform the tort system in favor of corporations, expand corporate immunity, and stop Americans from being able to seek justice when they are harmed.

Figure 2: Some of the Chamber of Commerce’s Most Litigated Issues

| Issue | Number of Cases |

| Court Access | 76 |

| Administrative Law | 66 |

| Torts and Product Liability | 66 |

| Jurisdiction | 60 |

| Environment | 47 |

| Employment/Labor Relations | 46 |

| ERISA | 42 |

| Federal Preemption and Commerce Clause | 30 |

| Capital Markets | 29 |

| Consumer Protection | 19 |

| Tax | 17 |

| False Claims Act | 12 |

| Corporate Free Speech | 8 |

A Parade of Evils: Recent Lowlights of the Chamber’s Legal Advocacy

Antitrust Roadblocks

The Chamber has utilized its legal resources to fight antitrust regulations and enforcement actions on some of the largest corporations in the world. On September 26, 2023, the Federal Trade Commission (FTC) and 17 state attorneys general filed a lawsuit against Amazon alleging that the corporate behemoth has been improperly engaging in monopolistic practices that not only harmed other businesses and the broader economy, but also had a direct negative impact on everyday consumers.[11]

And despite the Chamber’s purported representation of the interests of over 3 million businesses, the Chamber has recently come out in full force against the FTC in defense of Amazon and its business practices, using its legal resources to come to the company’s aid in the form of an amicus brief.[12] If the Chamber of Commerce represents the interests of over 3 million businesses, it should be in favor of antitrust enforcement that could level the playing field for the millions of small businesses across the nation.

Recent polling of independent retailers shows overwhelming support for more expansive regulation over Amazon’s practices, as 65% of respondents stated that Amazon’s control of the market was a significant challenge to their success.[13]

Consumers Beware

Dating back to its formation with the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, the Consumer Financial Protection Bureau (“CFPB”) has been working under authority from Congress to protect consumers from harms, scams, and rip-offs from corporate bad actors. And by making the CFPB independent from the onset, Congress intended to ensure that the agency was fully funded and protected from year-to-year efforts to hamper its progress and ability to sufficiently reach its goals.

Recently the agency has seen itself under fire from both corporate actors and its loyal organizational proxies. As a piece of this assault, the CFPB has found itself in the crosshairs of the Chamber.

In March of 2022, the CFPB made an internal change to its examination manual in order to better target discriminatory conduct. More specifically stating: “The CFPB will examine for discrimination in all consumer finance markets, including credit, servicing, collections, consumer reporting, payments, remittances, and deposits.”[14]

In September of 2022, the Chamber sued the CFPB challenging that the latest update to more actively address issues of discrimination was outside the scope of the agency’s statutory authority.[15] The Chamber also argued that the CFPB’s funding mechanism was unconstitutional (despite the fact that several other federal agencies operate the same way).

Further, the Chamber again submitted briefings on this issue in July of 2023 in a separate case to be decided by the Supreme Court next year, CFPB v. Community Financial Services Association of America, Ltd.[16], targeting the funding model of the agency yet again, throwing its very existence into jeopardy. Public Citizen issued an amicus brief,[17] fully reiterating our support for the agency’s work and arguing that the Appropriations Clause is duly satisfied, citing that an adverse ruling would put the Federal Reserve, the U.S. Postal Service, the Federal Deposit Insurance Corporation, U.S Citizenship and Immigration Services, Farm Credit Administration, U.S. Bureau of Engraving and Printing, Public Company Accounting Oversight Board, and Tennessee Valley Authority, among others, in jeopardy. These legal challenges lead directly to an unstable, volatile administrative landscape that directly harms the health of small businesses. If the economy relies on small businesses to be its bedrock, small businesses should be given a sturdy, reliable government that will be both dependable and securely funded.

And if the Chamber and its allies are successful in targeting the funding model of the CFPB, prospective small business owners would be harmed. By enforcing the Equal Credit Opportunity Act, a well-protected CFPB could actively work to give potential entrepreneurs a fair chance at business ownership, both further expanding the business landscape and bolstering the national economy.

Fighting Against Cheaper Medications

The Chamber of Commerce has used several legal forums to hinder the full implementation of the Inflation Reduction Act of 2022.

For example, the Inflation Reduction Act put in place a new program that would allow Medicare to negotiate drug prices with pharmaceutical companies and drug manufacturers to bring down the prices of certain covered high-price prescription drugs. [18] Specifically, the Centers for Medicare and Medicaid Services (CMS) will select single source Medicare drugs covered under Medicare Part B or Part D to be included in the negotiations.

In response, the Chamber came out strongly against the new mandate on constitutional grounds.[19] These legal challenges are already significantly delaying the rollout of a plan that would take costly life-saving drugs to more affordable prices. And with nearly 3 in 10 American adults being forced to either skip doses or leave their prescriptions unfilled due to rising costs, now is no time for the Chamber to stand in the way of this progress.[20]

Improved access to more affordable medications and treatments would benefit many small business owners, and the business owners themselves are aware of this fact. In a recent survey of small business owners by Small Business for America’s Future, 83% of respondents responded that rising healthcare costs had a negative impact on their business.[21]

Student Loan Debt Forever

The Chamber also had a significant hand in pushing the Supreme Court to halt student loan forgiveness proposals. As a part of the Biden Administration’s attempt to address our current student loan debt crisis, President Biden announced that he would utilize executive authority to cancel up to $400 billion of student loans by permanently canceling portions of every borrower’s student loan debt. Under the new executive action, $10,000 would be forgiven for every borrower earning less than $125,000 a year, including an additional $10,000 for Pell Grant recipients.[22]

Soon after, several states sued the U.S. government, alleging that the forgiveness program violated the separation of powers and the Administrative Procedure Act. After the case (Biden v. Nebraska) made its way all the way to the Supreme Court to reach final decision, the Chamber couldn’t resist the opportunity to jump in on the action against borrowers, filing an amicus brief in full support of the dismantling of the new forgiveness plan.[23] The Chamber even went as far as to release a celebratory statement when the Supreme Court ruled the transformational plan unconstitutional.[24]

Adequate finances are one of the largest challenges any potential entrepreneur faces when starting a small business. In a recent survey of small business owners, 30% of surveyed owners reported that student loan debt negatively affected their ability to expand their business.[25] Further saddling borrowers with a higher student loan debt balance only serves to damage the health and prosperity of both current and future small businesses.

Conclusion

The Chamber repeatedly “talks the talk” on fighting for the interests and empowerment of small businesses and everyday people trying to make a living. But its legal interventions on behalf of the largest corporations in America show the Chamber’s words ring hollow.

In fact, many of the arguments and declarations the Chamber makes on behalf of large businesses come at the direct detriment of the interests of small businesses across the country. The Chamber’s opposition to antitrust enforcement[26] actively helps create a marketplace dominated by exorbitantly large actors that make it difficult for both small businesses and startup companies to compete – far from the mom-and-pop oasis the trade group wishes us to believe it is fighting for. And as described previously, arguing for destructive legal rulings that throw much needed government agencies into funding jeopardy likewise damages the stability of local businesses across the country.

If the Chamber really wanted to help small businesses, there’s no lack of opportunity to begin advocating for the policies and legal rulings that most aid them.

[1] https://www.opensecrets.org/orgs/us-chamber-of-commerce/summary?toprecipcycle=2022&contribcycle=2022&lobcycle=2022&outspendcycle=2022&id=D000019798&topnumcycle=A

[2] https://www.uschamber.com/program/us-chamber-litigation-center

[3] Public Citizen has reported on the Chamber’s litigation activities in the past, with the most recent related Public Citizen Report analyzing the Chamber’s intervention in 500 cases between March 2013 and April 2016.

[4] For the purposes of this report, a small business was defined as a business having fewer than 500 employees. This definition is one of several used by the Small Business Administration. For more information, see, https://www.forbes.com/advisor/business-loans/sba-definition-of-small-business/

[5] See, e.g., About the U.S. Chamber, U.S. Chamber of Commerce, http://uscham.com/1N7Jz0s (viewed on April 29, 2016) and Statement of the U.S. Chamber of Commerce on Assessing the Effects of Consumer Finance Regulations, U.S. Chamber of Commerce, http://1.usa.gov/1N5n1b2 (viewed on April 29, 2016).

[6] For a detailed analysis of the Chamber’s preferred communications strategy of using small businesses to advocate for policies that benefit Big Business, see Bartlett Naylor & Daniel Dudis, Public Citizen, Sacrificing the Pawns (June 2016), http://bit.ly/28N1dnh (viewed on June 22, 2016).

[7] For the purposes of this report, a small business was defined as a business having fewer than 500 employees. This definition is one of several used by the Small Business Administration. For more information, see, http://1.usa.gov/236lzga.

[8] Frequently Asked Questions, Small Business Administration Office of Advocacy, https://advocacy.sba.gov/wp-content/uploads/2021/12/Small-Business-FAQ-Revised-December-2021.pdf

[9] The threshold for making the Fortune 500 in 2023 was $7.2 billion in revenues. See, https://www.prnewswire.com/news-releases/fortune-announces-2023-fortune-500-list-301841941.html

[10] https://www.uschamber.com/improving-government/suzanne-clarks-2023-state-of-american-business-remarks

[11] https://www.ftc.gov/system/files/ftc_gov/pdf/1910129AmazoneCommerceComplaintPublic.pdf

[12] https://www.uschamber.com/assets/documents/2023.10.25-FTC-v.-Amazon-Amicus-Brief-filed.pdf

[13] 2022 Independent Business Survey: Top Challenges and Policy Priorities https://ilsr.org/2022-survey-businesses/

[14] https://www.consumerfinance.gov/about-us/newsroom/cfpb-targets-unfair-discrimination-in-consumer-finance/

[15] https://www.axios.com/2022/09/28/chamber-sues-cfpb-over-its-anti-discrimination-policy

[16] https://www.uschamber.com/cases/capital-markets-and-corporate-law/cfpb-v-community-financial-services-association-of-america-limited

[17] https://www.citizen.org/wp-content/uploads/Consumer-Advocates-Amicus-brief-CFPB-v-CFSA-FINAL-for-printing.pdf

[18] https://www.cms.gov/files/document/fact-sheet-medicare-selected-drug-negotiation-list-ipay-2026.pdf

[19] https://www.politico.com/news/2023/08/29/drugmakers-trade-groups-push-back-against-medicare-drug-price-negotiations-00111936

[20] https://www.whitehouse.gov/briefing-room/presidential-actions/2022/10/14/executive-order-on-lowering-prescription-drug-costs-for-americans/

[21] https://www.smallbusinessforamericasfuture.org/as-congress-debates-social-spending-bill-national-survey-shows-small-business-owners-want-action-to-combat-rising-healthcare-and-prescription-drug-costs

[22] https://www.cnbc.com/2022/08/24/biden-expected-to-cancel-10000-in-federal-student-loan-debt-for-most-borrowers.html

[23] https://www.supremecourt.gov/DocketPDF/22/22-535/253897/20230203103301747_22-506%2022-535%20Amicus%20Brief.pdf

[24] https://www.uschamber.com/about/u-s-chamber-applauds-u-s-supreme-courts-decision-on-student-loans

[25] https://www.capitalone.com/about/insights-center/small-business-confidence-2022/

[26] Take for example the Chamber’s recently filed amicus in support of Microsoft, advocating for a narrow interpretation of antitrust law to shield Microsoft from enforcement. https://www.uschamber.com/cases/antitrust-and-competition-law/ftc-v-microsoft-corp