Big Crypto, Big Spending: Crypto Corporations Spend an Unprecedented $119 Million Influencing Elections

Key Findings

- In 2024, crypto corporations have poured over $119 million directly into influencing federal elections, primarily into a non-partisan super PAC dedicated to electing pro-crypto candidates and defeating crypto skeptics.

- Crypto corporations are by far the dominant corporate political spenders in 2024 as nearly half (44%) of all corporate money contributed during this year’s elections ($274 million so far) came from crypto backers.

- Koch Industries is a distant second place in 2024. The privately held conglomerate owned by Charles and, formerly, the late David Koch, contributed $25 million to its Koch-controlled Americans for Prosperity Action and $3.25 million toward electing Republicans to Congress.

- Direct corporate election spending at this scale is unprecedented. Crypto corporations’ total spending in the past three election cycles – $129 million – already amounts to 15% of all known corporate contributions since the Supreme Court’s 2010 ruling in Citizens United, which total $884 million. 92% of the corporate crypto spending is from 2024.

- Since Citizens United, the crypto corporations are now second in total election-related spending, trailing only fossil fuel corporations, which have spent $176 million over the past 14 years, including $73 million from Koch Industries.

- The crypto sector’s Fairshake PAC and its affiliates have received nearly $114 million directly from corporate backers, far more than any other outside spender this cycle. Koch-backed Americans for Prosperity Action, a hybrid PAC, is a distant second, having received nearly $26 million, primarily from Koch Industries.

- Fairshake’s corporate backing is unprecedented. Though unlimited corporate contributions have been enabled since 2010 by Citizens United, this newcomer is already second only to the super PAC dedicated to electing Republicans to the U.S. Senate in terms of corporate money received. That super PAC, the Senate Leadership Fund, has received nearly $119 million directly from corporations over the past 14 years, largely from fossil fuel corporations but including many other sectors, including crypto, tobacco, and for-profit prisons.

Note: Findings are based on Public Citizen analysis of federal election data provided by OpenSecrets showing all contributions of $5,000 or more by for-profit corporations to super PACs and hybrid PACs between 2010 and June 30, 2024.

Introduction

Cryptocurrency corporations are spending big to make crypto regulation a top issue for candidates in the 2024 elections.

Crypto-sector corporations – primarily Coinbase and Ripple – have dumped over $119 million in real dollars into the 2024 elections so far, almost entirely into super PACs dedicated to elevating pro-crypto candidates and attacking crypto skeptics (see Table 1).

The primary beneficiary of the corporate crypto cash is Fairshake PAC, a super PAC that has raised $202.9 million. More than half of Fairshake’s funding – $107.9 million, or 53% – came directly from corporations that stand to profit from the PAC’s efforts, mostly Coinbase and Ripple. The rest of the PAC’s funds mostly comes from billionaire crypto executives and venture capitalists, including $44 million from the founders of venture capital firm Andreessen Horowitz, $5 million from the Winklevoss twins, and $1 million from Coinbase CEO Brian Armstrong.

This tsunami of corporate crypto cash is a brazen and unprecedented attempt by for-profit businesses to force their private, pecuniary priorities ahead of the public interest. “Money moves the needle,” Coinbase’s billionaire CEO Brian Armstrong told Axios. “For better or worse, that’s how our system works.”

For Americans hopeful the federal government will prioritize their interest in a stable economy and crack down on Ponzi-like schemes and scams, crypto’s corporate influence corrupting our political process can only be for worse.

Table 1: Crypto sector corporation contributions to influence the 2024 elections.

| Crypto Sector Corporation | Total 2024 Contributions | Recipients | Amount |

|---|---|---|---|

| Coinbase | $50,499,995 | Fairshake PAC | $45,499,995 |

| Protect Progress (Fairshake affiliate) | $1,500,000 | ||

| Defend American Jobs (Fairshake affiliate) | $1,500,000 | ||

| Senate Leadership Fund (Republican PAC) | $500,000 | ||

| Senate Majority PAC (Democratic PAC) | $500,000 | ||

| Congressional Leadership Fund (Republican PAC) | $500,000 | ||

| House Majority PAC (Democratic PAC) | $500,000 | ||

| Ripple | $49,000,000 | Fairshake PAC | $45,000,000 |

| Protect Progress (Fairshake affiliate) | $1,500,000 | ||

| Defend American Jobs (Fairshake affiliate) | $1,500,000 | ||

| Commonwealth Unity Fund (John Deaton super PAC) | $1,000,000 | ||

| Jump Crypto | $15,000,000 | Fairshake PAC | $15,000,000 |

| Andreessen Horowitz | $1,750,000 | Senate Majority PAC (Democratic PAC) | $750,000 |

| Congressional Leadership Fund (Republican PAC) | $500,000 | ||

| Senate Leadership Fund (Republican PAC) | $250,000 | ||

| House Majority PAC (Democratic PAC) | $250,000 | ||

| Payward Inc | $1,000,000 | Fairshake PAC | $1,000,000 |

| Circle Internet Financial | $1,000,000 | Fairshake PAC | $1,000,000 |

| Paradigm Operations Lp | $1,000,000 | Sentinel Action Fund (conservative crypto PAC) | $500,000 |

| Congressional Leadership Fund (Republican PAC) | $250,000 | ||

| Senate Majority PAC (Democratic PAC) | $250,000 |

Data Source: OpenSecrets.org

Because of the 2010 U.S. Supreme Court ruling in Citizens United v. Federal Election Commission, corporations can spend as much as they want to tilt elections toward their favored candidates. There are, however, some limits on corporate political spending. Corporations cannot contribute directly to campaigns, but they can contribute unlimited funds to super PACs and other types of outside groups if those groups do not coordinate directly with candidates’ official campaign operations. Longstanding anti-“pay-to-play” laws prohibit corporations that have contracts with the federal government from contributing to electoral campaigns. (Public Citizen joined a complaint filed with the FEC alleging Coinbase’s $25 million contribution to Fairshake and $500,000 contribution to the Congressional Leadership Fund were made in violation of this law, as Coinbase is a federal contractor with the US Marshals service and the contributions were made when the corporation was legally prohibited from doing so.)

The decade after the Citizens United ruling led to a massive surge of contributions from super PACs. Contributions to super PACs were dominated by billionaires, with just 25 wealthy individuals contributing about $1.4 billion, over that period – nearly half of super PAC contributions. Direct corporate contributions totaled just $313 million between 2010 and 2020.

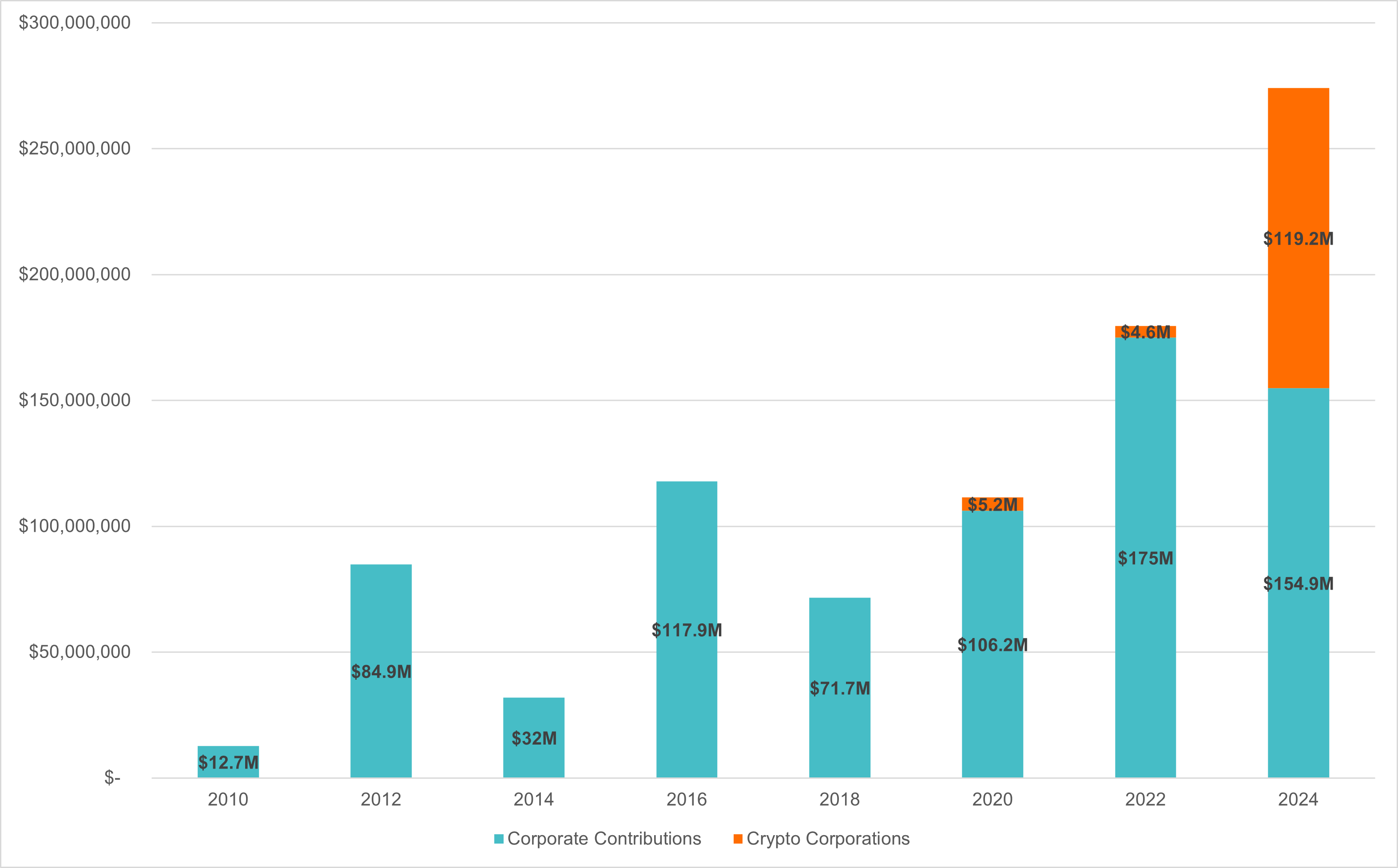

Crypto corporations’ total spending in the past three election cycles – $129 million – already amounts to 15% of all known corporate contributions since 2010, which now total $884 million. Direct corporate election spending at this scale is unprecedented (see Chart 1).

Crypto corporations are already second in total election-related spending, trailing only fossil fuel corporations, which have spent $176 million over the past 14 years, including $73 million from Koch Industries, a notoriously prolific corporate contributor to Americans for Prosperity, a particularly active backer of “Tea Party” Republicans during the Obama administration.

Chart 1: Corporate contributions to influence federal election after Citizens United highlighting contributions by crypto corporations

Data Source: OpenSecrets.org

This analysis is by necessity limited only to corporate contributions to super PACs and hybrid PACs, which are disclosed to the Federal Election Commission. A hybrid PAC has one bank account that can make direct expenditures to back candidates, operating with all the limits of a traditional PAC, and a separate bank account that operates as a super PAC, raising and spending unlimited sums from corporations and wealthy donors as long as there is no direct coordination with candidates. Corporations can and do also contribute to Dark Money groups organized as 501(c)(4) nonprofits or 501(c)(6) business groups, which are not required to disclose their backers. A pro-crypto Dark Money group, the Cedar Innovation Foundation, is already running online ads targeting Senators Sherrod Brown (D-Ohio) and Elizabeth Warren (D-Mass.), who are seen as crypto skeptics.

Big Crypto’s Big Spending Strategy

So far, Big Crypto’s big spending strategy appears to be paying off:

- Big Crypto pledged to spend in the Montana senate race – without saying which candidate would be supported or opposed – and Sen. Jon Tester (D-Mont.), who has been skeptical of the sector, voted to pass pro-crypto legislation.

- Out of 42 primary races where crypto-backed super PACs intervened, the crypto sector won its preferred outcome in 36.

- When House Republicans brought crypto-backed legislation to shift regulatory responsibility from the SEC to the Commodity Futures Trading Commission for a vote in May, 71 Democratic House members defied the Biden administration by voting to pass the bill. Titled the Financial Innovation and Technology for the 21st Century Act, the bill, if it becomes law, is widely seen as legitimizing crypto.

- Donald Trump, who previously expressed skepticism toward the sector and whose Securities and Exchange Commission initiated tough enforcement against alleged crypto misconduct, has rebranded himself as the pro-crypto presidential candidate. Speaking at the Bitcoin Conference in July, Trump vowed to make the U.S. the “crypto capital of the planet and the bitcoin superpower of the world” and proposed the federal government hold a “strategic bitcoin reserve.”

- Trump’s running mate selection of Sen. J.D. Vance (R-Ohio), whose background in venture capital and crypto-friendly policies, is seen as another pro-crypto signal.

- Kamala Harris advisers, meanwhile, have reportedly reached out to crypto corporations to “reset”

- Senate Majority Leader Chuck Schumer (D-N.Y.) spoke at a “Crypto4Harris” virtual fundraiser in August, declaring, “Crypto is here to stay no matter what. So Congress must get it right … we all believe in the future of crypto.” Sens. Kirsten Gillibrand (D-N.Y.) and Debbie Stabenow (D-Mich.) also participated.

It was just two years ago, during the 2022 midterm elections, when FTX CEO (and now-convicted felon) Sam Bankman-Fried personified the cryptocurrency sector’s attempt to use campaign spending to maximize its political influence. Bankman-Fried spent more than $40 million in disclosed contributions, primarily supporting Democrats. After the election, Bankman-Fried claimed he also spent about the same amount backing Republicans, stating in an interview, “all my Republican donations were dark” and estimating he might have been the “second or third biggest” donor to Republicans in the cycle.

Now the even partisan split in both houses of Congress means the crypto sector’s outsized influence in competitive races has the potential to tip control of Congress one way or the other.

If crypto corporations are successful in directly leveraging their financial power into political power, more corporations and business sectors may follow the same playbook.

To be fair, crypto did not invent the corporate political influence strategy of rewarding candidates who agree to do an industry’s bidding while threatening those who resist corporate power. But no industry has ever before has so wholeheartedly embraced raising as much directly from corporations and openly using that political war chest as a looming threat (or reward) to discipline lawmakers toward adopting an industry’s preferred policies.

Crypto sector spokespersons claim to represent a vast voting bloc, but the claim has little credibility. The sector itself offers skewed statistics that exaggerate the number of Americans who dabble in digital money, but a survey by the Federal Reserve finds only about 7% of Americans held or used crypto in 2023.

Crypto has its enthusiasts, to be sure. But if the hype was no more consequential than a handful of hobbyists collecting digital coins the way others might collect postage stamps or baseball cards, there would be little harm in letting crypto fans have their fun.

However, crypto enthusiasts treat cryptocurrencies as speculative assets – a use that is encouraged by crypto corporations and an ecosystem of crypto media. But it is worth emphasizing over and over again that, unlike commodities, corporate securities, or real “fiat” currency that has the backing of the federal government, there is nothing with any intrinsic value underlying crypto. Crypto’s volatility and risk remain extreme.

As the massive fraud perpetrated by Sam Bankman-Fried’s fallen crypto exchange FTX showed, untrustworthy insiders can abuse consumers, using their payments of real cash for personal purposes. It may be understandable why some technology-curious insiders with money to burn might find experimenting with crypto to be worth the risk, but pushing everyday investors with student debts and retirement savings into risky digital assets is a disaster waiting to happen.

Additionally, crypto has been found to be particularly useful for criminal enterprises that exploit the blockchain as an alternative to the regulated financial system, where sophisticated systems are in place for detecting tax evasion, money laundering, ransom payments, and the like.

Both Coinbase and Ripple have been fighting securities fraud charges from the U.S. Securities and Exchange Commission.

If a widespread grassroots constituency supporting the crypto political agenda existed, one might expect that Fairshake would be tapping into it and touting in its advertisements that it is fighting for the constituency’s interests. That’s not what Fairshake is doing.

On the contrary, when Fairshake and its affiliates spend money to influence races, either by attacking crypto skeptics or boosting crypto supporters, the ads don’t mention crypto at all. The super PAC spent $10 million on ads against Rep. Katie Porter in California’s Senate primary and $2 million against Rep. Jamaal Bowman in a primary contest in New York. Rather than criticizing candidates for not sufficiently supporting crypto, both attack campaigns smeared the candidates’ using unflattering claims having nothing to do with crypto policy.

Similarly, the $3 million campaign by Defend American Jobs PAC, Fairshake’s affiliate for intervening in Republican primaries, features an ad supporting Gov. Jim Justice for the Senate that makes no mention of cryptocurrency.

The super PAC recently pledged to spend $25 million backing 18 House candidates – nine Democrats and nine Republicans – in the general election. Fairshake also announced that it would spend $18 million on three Senate races. The Senate race spending includes $12 million pledged to back Ohio Republican Bernie Moreno, who been described as a “crypto fan” and “blockchain businessman,” against incumbent Democrat and Senate Banking Chairman Sen. Sherrod Brown, as well as $3 million backing Arizona Democratic Senate candidate Rep. Ruben Gallego and $3 million backing Michigan Democratic Senate candidate Rep. Elisa Slotkin. Gallego and Slotkin both voted in defiance of the Biden administration for the legislation transferring authority over crypto from the SEC to the CFTC.

It will be interesting to see if Fairshake’s pattern of concealing its crypto agenda when attempting to influence voters, even as it makes its policy priorities extremely clear to candidates.

Fairshake spokesman Josh Vlasto, a former chief of staff for New York Gov. Andrew Cuomo and a top aide to Sen. Chuck Schumer (D-N.Y.), said “We’ll have the resources to affect races and the makeup of institutions at every level. And we’ll leverage those assets strategically to maximize their impact in order to build a sustainable, bipartisan crypto and blockchain coalition.”

In Ohio, incumbent Sen. Sherrod Brown (D) is seeking reelection, and in Montana, incumbent Sen. Jon Tester (D) is seeking reelection. Both incumbent Democrats are seen as vulnerable, as both are running in states where Trump’s presidential campaign won in 2020. Fairshake’s Vlasto told the New York Times in March that the super PAC has not decided whether to support or oppose either candidate, though both senators are seen as crypto skeptics. Only in August did Fairshake announce its plans to spend against Brown – and, after Tester’s crypto-friendly vote, has yet to announce further plans for Montana.

The super PAC appears to be adopting a strategy of amassing the biggest political war chest that it can, and to use that war chest itself as an unspecified threat. Fairshake’s lack of clear political affiliation means its spending could be deployed against either Republicans or Democrats. There appears to be an implicit promise the super PAC will stand down in races where both Democrats and Republicans demonstrate willingness to pander to Big Crypto. This Big Crypto threat in many districts combined with targeted deployments has already changed dynamics in races and in Congress. It is akin to a corporate Death Star hovering over elections, poised to annihilate individual candidates in order to instill a discipline – acquiescence to corporate demands – among all candidates.

The crypto sector strategy seems to be: give crypto corporations what they want, or your political career gets it. Or, as former Coinbase CTO Balaji Srinivasan posted on X (formerly Twitter), “Attacking crypto means risking your seat.”

The strategy, however, is not without risk. After Fairshake announced its bipartisan political spending intentions, Republicans accused Fairshake of betrayal for backing Democratic senate candidates in Arizona and Michigan, while Democratic megadonor Ron Conway disavowed Fairshake after the super PAC announced it would back the Republican senate candidate in Ohio. “Because of your selfish hidden agendas it is time for us to separate,” Conway wrote. “This is a wake up call to myself that I have been working too long with people who [do] not share common values and that is unacceptable. … I will I [sic] no longer compromise myself by associating or helping.”

Big Crypto’s Campaign Strategy in Context

Crypto’s strategy is different from how corporations usually influence elections with their political contributions, and not just in the scale of contributions made.

Typically, disclosed corporate political contributions go to partisan outside groups, usually Republican affiliated (see Table 2). Aside from crypto, the other corporate contributors of 2024 follow this pattern. Republican-backing groups have a nearly four-to-one advantage in corporate funding, with $122.9 million in contributions from corporations going to right-leaning groups with $32.6 million going to groups that support Democrats.

In 2024, half of corporate contributions to Republican-backing groups ($69 million) went to just three groups: the Kochs’ Americans for Prosperity Action ($25.9 million), the Senate Leadership Fund ($22.4 million), and the Congressional Leadership Fund ($20.7 million). Similarly, about a third of corporate contributions toward Democrat-backing groups ($9.6 million) went to two groups dedicated to electing Democrats to the Senate and House, respectively: Senate Majority PAC ($5.8 million) and House Majority PAC ($3.8 million).

The top corporation among the crypto political spenders, Coinbase, is also contributing to partisan PACs in the 2024 cycle. But Coinbase’s strategy of withholding full commitment to either political party again stands out, as the corporation made four $500,000 donations – one to elect Republicans to the Senate, one to elect Democrats to the Senate, one to elect Republicans to the House, and one to elect Democrats to the House.

The vast majority of Coinbase and Ripple’s contributions have gone to the nonpartisan FairShake Super PAC.

Table 2: Top ten corporate campaign funders of 2024 and the political leanings of their funding recipients.

| Corporation | Contribution | Top Recipient | Political Lean |

|---|---|---|---|

| Coinbase | $50,499,995 | Fairshake | Non-specified |

| Ripple | $48,000,000 | Fairshake | Non-specified |

| Koch Industries | $28,250,000 | Americans for Prosperity Action | Republican |

| Jump Crypto | $15,000,000 | Fairshake | Non-specified |

| Pivotal Ventures (Melinda Gates) | $7,475,000 | Campaign for a Family Friendly Economy PAC | Democratic |

| Chevron Corp | $5,975,000 | Senate Leadership Fund | Republican |

| RAI Services Co (Reynolds American, a British American Tobacco subsidiary) | $5,500,000 | Make America Great Again Inc | Republican |

| Occidental Petroleum | $5,000,000 | Senate Leadership Fund | Republican |

| Hillwood Development | $4,900,000 | Senate Leadership Fund and Congressional Leadership Fund | Republican |

| Planeta Management LLC (Nicole Shanahan) | $4,500,000 | American Values 2024 | Independent (Robert Kennedy, Jr.) |

Data Source: OpenSecrets.org

The pattern of corporate contributions aside from crypto benefiting partisan groups is even more pronounced when corporate contributions since 2010 are examined (see Table 3).

Since 2010, Republican-backing groups have a four-to-one advantage, with $609.1 million in contributions from corporations going to right-leaning groups while $144.6 million is going to groups that support Democrats.

Over half of the corporate contributions toward Republican-backing groups (310.2 million) went to just four groups: the Senate Leadership Fund ($118.9 million), Congressional Leadership Fund ($93.2 million), Americans for Prosperity Action ($59 million) and Karl Rove’s American Crossroads ($39 million). Similarly, about 40% of the corporate contributions toward Democrat-backing groups ($60.3 million) went to two groups dedicated to electing Democrats to the Senate and House, respectively: Senate Majority PAC ($46.1 million) and House Majority PAC ($14.3 million).

Considering all corporate contributions since 2010 also highlights the magnitude of the crypto sector’s 2024 spending. The sector did not start intervening in elections until 2020, when Sam Bankman-Fried’s Alameda Research contributed $5.2 million to Future Forward, a hybrid PAC that supported the Biden-Harris campaign. Four years later, Coinbase is second only Koch Industries in terms of its spending to influence federal elections.

Table 3: Top ten corporate campaign funders since 2010 and political leanings of funding recipients.

| Corporation | Contributions | Top Recipient | Political Lean |

|---|---|---|---|

| Koch Industries | $69,335,000 | Americans for Prosperity Action | Republican |

| Coinbase | $50,499,995 | Fairshake | Non-specified |

| Ripple | $48,500,000 | Fairshake | Non-specified |

| Chevron Corp | $28,952,500 | Senate Leadership Fund | Republican |

| Amalgamated Bank | $25,739,195 | Senate Majority PAC | Democratic |

| Hillwood Development | $19,818,980 | Senate Leadership Fund | Republican |

| CV Starr & Co | $16,267,500 | Right to Rise USA | Republican |

| RAI Services Co (Reynolds American, a British American Tobacco subsidiary) | $15,107,500 | Senate Leadership Fund | Republican |

| Jump Crypto | $15,000,000 | Fairshake | Non-specified |

| Occidental Petroleum | $13,610,000 | Senate Leadership Fund | Republican |

Data Source: OpenSecrets.org

Crypto corporations’ total spending in the past three election cycles – $129 million – already amounts to 15% of all known corporate contributions since the Supreme Court’s 2010 ruling in Citizens United, which total $884 million. In terms of corporate money in politics since 2010, the crypto corporations are second only to fossil fuel corporations, which have spent $162 million over the past 14 years, including $73 million from Koch Industries (see Table 4). But crypto corporations made 92% of their record-breaking contributions in 2024 alone – and, of course, may still contribute more.

Table 4: Contributions by top corporate sectors giving $1 million or more since 2010

| Sector | Amount | Top Donors |

|---|---|---|

| Fossil Fuels | $176.1 million | Koch Industries, Chevron, Occidental Petroleum |

| Cryptocurrency | $128 million | Coinbase, Ripple, Jump Crypto |

| Political / Personal Purpose* | $41.4 million | Specialty Group Inc (William S. Rose), Planeta Management LLC (Nicole Shanahan), Besilu Stables (Benjamin Leon, Jr.) |

| Real Estate | $38.5 million | Hillwood Development, Crow Holdings, Klein Financial |

| Private Holding Company | $31.1 million | TRT Holdings, Access Industries, Contran Corp |

| Finance | $26.3 million | CV Starr & Co. and Starr International USA, Stephens Inc., Allied Wallet |

| Finance / Labor | $25.7 million | Amalgamated Bank** |

| Tobacco | $23 million | Reynolds American (British American Tobacco subsidiary), Altria Client Servies (Philip Morris affiliate) |

| Food and Agriculture | $20.7 million | Mountaire Corp., Weaver Popcorn, Dixie Rice Agricultural Corp. and Southwest Louisiana Land (Harold Simmons) |

| Energy | $13.3 million | Alliance Resource Partners, NextEra Energy, Pinnacle West Capital |

Data Source: OpenSecrets.org

*Political / Personal Purpose refers to contributions made by corporate entities that appear to have been created primarily to advance the interests of their individual owners.

**Amalgamated Bank, a union-owned financial institution whose political engagement often differs from that of other financial institutions.

In many cases, contributions by corporations appear to be used as extensions of their wealthy owners’ political activities. This is particularly true of privately held entities and LLCs. An extreme example of this is Planeta Management, which is controlled by Robert F. Kennedy, Jr.’s running mate, Nicole Shanahan, and gave $4 million to American Values 2024, a super PAC backing Kennedy’s presidential campaign. Similarly, Amalgamated Bank’s spending to support Democrats is an expression of the bank’s labor ownership. Republicans, nevertheless, have overwhelmingly benefitted from corporate contributions, having received $609 million in contributions since 2010, or 69% of the total (see Table 5).

Table 5: Contributions since 2010 by recipient viewpoint

| Recipient Viewpoint | Amount Received |

|---|---|

| Backs Republicans | $609.1 million |

| Backs Democrats | $144.6 million |

| Non-Specified / Independent | $130.8 million |

| Total | $884.5 million |

Data Source: OpenSecrets.org

Conclusion

The threat of Big Crypto’s big spending looms large in 2024, especially in contested races such as the Ohio and Montana Senate contests, where incumbent Democrats are defending vulnerable seats that would cost them control of the chamber. The cryptocurrency sector is not the first corporate interest to seek to distort our democracy by converting its financial power into political power, but the magnitude of its corporate spending and its strategy of withholding partisan support is unusual. The strategy has been effective so far. Candidates are clamoring to demonstrate their willingness to pander to crypto corporations, and sitting lawmakers are backing off tough policy stances. It is a clear indication that the Supreme Court’s 2010 ruling in Citizens United is a serious factor in the 2024 elections – and a threat to our democracy.

Despite cryptocurrency marketing claims that digital assets herald a future financial system that promises to be decentralized, efficient, fairer, and more affordable, the Ponzi-like schemes and whipsaw volatility that have characterized the crypto sector have shown these experiments in artificial currency to be of dubious value.

This makes crypto’s influence even more dangerous. Crypto-influenced lawmakers bending over backwards to benefit Big Crypto means weaker protections preventing individual consumers from being defrauded by reckless crypto scams – and softened regulations protecting our financial system from destructive innovations that exploit consumers while enriching insiders.

There’s one other great danger from this trend: With the crypto companies shattering the norm of corporate reticence to make large-scale contributions to affect election outcomes, there’s a grave danger that other corporations will follow suit.

We’ve already had enough of elected officials looking the other way because influential billionaires and Big Businesses told them to. Regulators and lawmakers should be free to carry out their public interest missions without fear of political attacks from corporate interests.

The influence of Big Crypto is more evidence a constitutional amendment is needed to overturn Citizens United – and restore our democracy to one where people call the shots, not corporations.